With central banks now poised to plunge headlong back down the accommodation rabbit hole in an effort to bolster flagging inflation expectations and keep the global manufacturing slump from spilling over into the services sector and, ultimately, the labor market, market participants are again fretting about “policy impotence”.

In short, the worry is that with rates, at best, just barely off the lower bound and, at worst, still mired in NIRP, and with balance sheets still bloated, the capacity for policymakers to deploy more stimulus is limited.

This is the “ammo” problem, and it pops up whenever it appears the global economy is set to roll over, forcing everyone to admit that, a decade on from the crisis, the legacy of emergency monetary policy is still with us in a very literal sense – the policies haven’t been unwound.

Read more: The ‘Ammo’ Problem Is Back — And It’s Worse Than Ever

Over the weekend, we noted that some see the Fed cutting rates back near zero by 2021 and a non-trivial percentage of market participants believe nothing can resurrect inflation expectations across the pond in Europe. It thus comes as no surprise that “monetary policy impotence” jumped to #2 on BofA’s top tail risk list in the July installment of the popular Global Fund Manager survey.

The poll also highlighted another worrying aspect of central banks’ renewed commitment to deploying more easing and stimulus: Excessive leverage and the read-through for “zombies”.

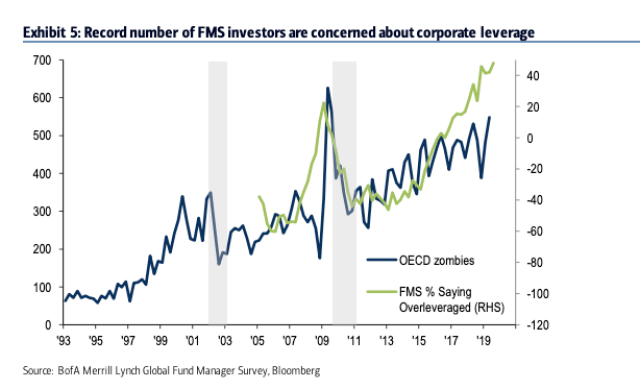

“A record 48% of FMS investors say corporates are excessively levered”, BofA’s Michael Hartnett writes, describing the following visual, which illustrates the relationship between the percentage of survey participants who say corporates are over-leveraged and the number of OECD zombie companies, defined as companies with an interest coverage ratio below 1.

(BofA)

As you can see, “zombies” have reached a new post-GFC high at 548.

Remember, the post-crisis monetary policy regime effectively serves as a zombie creation lab. “Rather than financial markets efficiently allocating capital to productive, growth-rich companies, investors’ desire to reach for yield amid a low rate world means inefficient, ex-growth firms are able to secure funding and roll-over debt”, BofA’s Barnaby Martin wrote in May, updating his previous work on the walking dead (if you will).

“The end result is impressively low default rates, but also a clustering of companies across the market where their long-term existence is highly questionable”, Martin continued. “Easy money creates a lifeline for ‘zombie’ firms to persist”.

The ultimate irony, of course, is that the proliferation of zombies arguably acts as a deflationary force. That is, excessive and prolonged central bank accommodation has paradoxically served to create a disinflationary impulse in some sectors of the economy when otherwise insolvent production is allowed to remain online or hibernate — as opposed to going out of business.

With investors starving for any semblance of yield, markets remain open to companies that would, under normal circumstances, have lost access. Poor balance sheet discipline has been rewarded rather than punished and far from being purged, misallocated capital becomes even more misallocated.

The end result: Zombies. Lots of them. And with them, the very same disinflation that central banks are ostensibly trying to vanquish.

Other than that , and especially including the peace and stability in World Geopolitics we have an economic system ( running like a well oiled clock , led by a large brained genius ) that is worthy of equities at record highs….Right???

The other side of the coin of very low interest rates is very low rates of return on investment. This will mean among other things that almost all of the very high p/ e stocks are guaranteed to disappoint investors ; the question is just when.

And very low rates of return discourage future investment. Less future investment means fewer jobs in the future with the associated social unrest

But it does make for the very best time to START a business.