If you ask US credit investors, there’s a lot less to worry about now than there was just two months ago – or at least according to those who responded to BofAML’s latest survey.

Compared to January, respondents are “notably” less concerned about the “usual suspects” (if you will), whether it’s China, the trade war and/or a US recession.

Here’s the breakdown, for those who want a granular look:

(BofAML)

Receding fear compared to January isn’t exactly a surprise. After all, the Fed’s dovish pivot helped allay fears that Jerome Powell was inexplicably hell-bent on hiking the US economy into a recession and the incessant drumbeat of upbeat trade headlines made a deal between Trump and Xi seem like a foregone conclusion (right up until late last week, anyway).

When it comes to credit specifically, both IG and HY rallied sharply in the new year, a welcome reprieve following the rather dramatic spread widening that characterized Q4, when the market was abuzz with chatter about the “BBB apocalypse” in IG, late-cycle worries in HY and shrill cries about a bursting of the leveraged loan bubble.

Oh, what a difference a few months makes.

“The most notable change in our fresh survey of US credit investors is that most concerns have declined notably from December and January”, BofAML’s Hans Mikkelsen writes, in a note documenting the survey results. “US credit investors never bought into market concerns about elevated recession risks priced into financial markets at the turn of the year”, he adds.

Here’s the “sum of all concerns” chart that’s making the rounds on Monday:

(BofAML)

Obviously, the Fed’s dovish relent has reset expectations around the likely path for rates rather dramatically, with just 17% expecting two hikes a year, down from 47% in January.

(BofAML)

One other standout from the March survey is that respondents once again think spreads are overvalued. You’re reminded that investors described credit as cheap in January for the first time since 2016, a development that underscored the depth of the Q4 selloff. The fact that the same investors now find spreads rich highlights how dramatic the rally has been.

(BofAML)

That said, BofAML notes that respondents still “expect a touch of spread tightening [during] the coming three months.” After that, it’s a different story with “widening forecast for medium to longer term horizons.”

Ok, whatever, right?

And not in that kind of way where you doubt the conviction of the respondents or the veracity of the survey, but rather in that kind of way where it’s a slow Monday and we’re talking about a poll of credit investors.

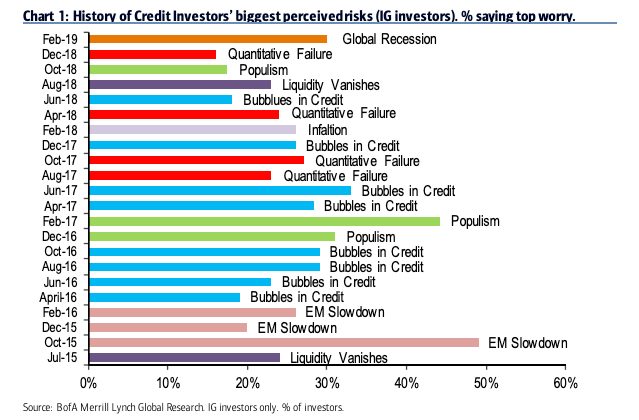

Anyway, maybe the folks polled by Mikkelsen can cheer up their counterparts across the pond, because according to Barnaby Martin’s € credit investor poll, a global recession is the biggest perceived risk “by the strongest consensus for any single worry since Jun-17 when Credit Bubbles was at 33%.”

(BofAML)