Well, Thursday turned out not to be the best day for European equities.

We decided to give it until the close across the pond to see if maybe things turned around, but, they didn’t.

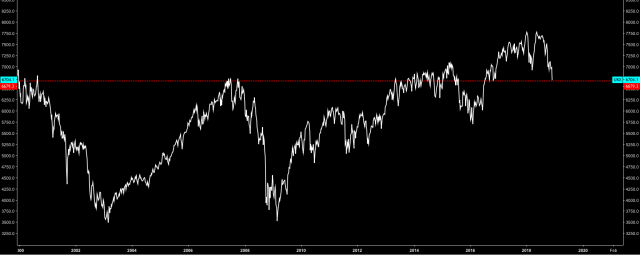

In fact, this was the worst day for European equities since Brexit and we can’t think of very many sentences that contain the phrase “since Brexit” which carry a positive connotation. Here’s the Stoxx 600, which is sitting at its lowest levels in two years.

(Bloomberg)

As was the case with the rout in mainland and Hong Kong shares on Thursday, there’s not a whole lot of nuance to this situation.

The arrest of Huawei Technologies CFO Wanzhou Meng and the collapse in S&P futures conspired to deep-six sentiment and unlike their Asian counterparts, European shares had the misfortune of being open during the U.S. cash session, which meant they (European equities) also took a hit from the rapidly deteriorating situation on Wall Street. The VStoxx obviously spiked.

Unsurprisingly given the Huawei news, trade-sensitive sectors were hit the worst. The poor SXAP dove 4.2%, adding insult to injury for Europe’s worst-performing sector. Again, it was a “worst day since Brexit” type of deal.

No sector on the Stoxx 600 rose on the day.

(Bloomberg)

For its part, the DAX is now in a bear market, after diving 3.5% during Thursday’s bloodbath.

The beleaguered Stoxx 600 banks index is mired in a horrific bear market and was down a grievous 4%.

Here’s the YTD snapshot:

(Bloomberg)

U.K. stocks are now negative for the century – literally.

For U.K. equities, the global turmoil comes at the worst possible time as Theresa May struggles to cram a Brexit deal that literally nobody likes/wants through Parliament.

And so on and so forth, but I imagine you get the idea. It’s “not good, not good”, as Trump would say.

Bear in mind that this comes just as the ECB is all set to wind down APP at the end of the month. That is becoming an increasingly untenable proposition, although backing off of that now might actually do more harm than good considering what it would tip about sentiment among policy makers.

Hopefully, Draghi’s state-and-dependent forward guidance will keep things from falling apart completely, but all it’s going to take are a couple of negative Brexit headlines and/or Trump moving ahead with auto tariffs and/or some kind of dramatic escalation in the ongoing budget battle between Rome and Brussels to sour sentiment even further.

There are a lot of “and/or”s there.

What if the global sell-off is the result of Quantitative Tightening?

Maybe we should call Quantitative Tightening … “The fed PUT”!

http://www.zealllc.com/2018/fedqtbdk.htm