In keeping with standard, Trump administration procedure when it comes to informing the public about sensitive foreign policy negotiations, the President decided to tweet his version of the details from a phone call he claims he had on Thursday with Xi Jinping.

“Just had a long and very good conversation with President Xi Jinping of China”, Trump said on Thursday morning, adding that the two “talked about many subjects, with a heavy emphasis on Trade.” Trade was capitalized, despite not being a proper noun.

“Those discussions are moving along nicely with meetings being scheduled at the G-20 in Argentina”, Trump continued, before exclaiming that he and Xi “also had good discussion on North Korea!”

“!!!!!”

Of course Trump needn’t actually call Xi to let the Chinese President know what the administration is thinking, because Chinese spies are already listening to everything Trump says when he dials up friends to rant. But I guess there’s no harm in having an “official” dialogue.

It’s not entirely clear what the point of today’s call was, but one imagines Trump is starting to understand the necessity of delivering good news on the trade front in light of October’s egregious selloff in U.S. stocks.

As we’ve tried to make clear since June, Xi isn’t worried about any “elections” – he’s going to lead China for as long as he wants to lead China and as far as the stock market is concerned, don’t forget that Beijing has an actual plunge protection team that can be deployed in emergencies to stabilize equities. If that doesn’t work, they can always just halt everything (or damn near everything) like they did during the 2015 crash.

Read more

Who’s Really ‘Winning’ The Trade War? The Truth Behind The Rhetoric

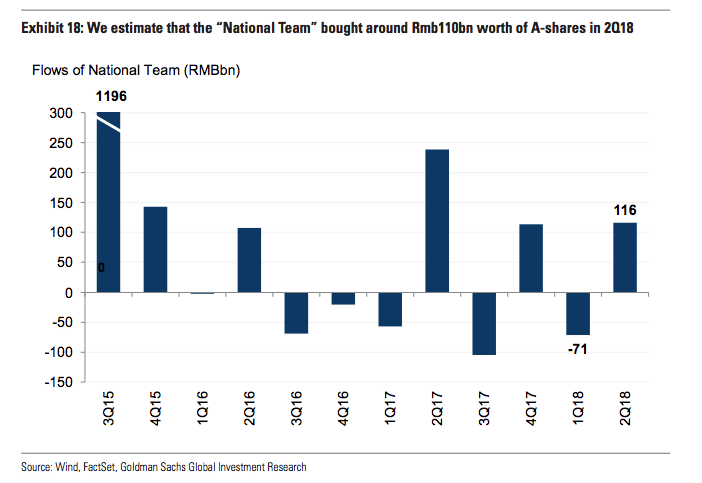

On Goldman’s estimates, the National Team collectively bought ~110 billion yuan worth of shares in the second quarter. “Our proxies suggest the ‘National Team’ may be supporting the market, at least during the latest sell-off, although the size of intervention may not be as significant as it was during the 2015 market meltdownâ€, the bank wrote, in a note out late last month.

Sure, China could lose control of things, but Beijing has demonstrated time and again that they are more adept at keeping all the spinning plates aloft than naysayers are inclined to admit.

How many times have you heard, over the last several years, that Beijing won’t be able to de-leverage without something breaking? How many times have you heard that internationalization of the yuan isn’t possible given the PBoC’s penchant for occasional draconian interventions? How many times have you heard that the debt bubble would pop? How many times have you heard the shadow banking bomb was going to explode?

Through it all, China has persevered.

Donald Trump isn’t the existential crisis for Beijing that many people (including Trump himself) seem to believe. Meanwhile, Trump’s grip on power is inherently tenuous. Despite his successful attempts to erode America’s checks and balances, the leeway the GOP has afforded him is largely down to the fact that his base is so fervent. If that base starts to believe the trade war is taking a toll on things and that Trump was wrong to suggest China would blink, well then their support might waver.

If that happens, Trump’s clout with GOP lawmakers could fade, because with the exception of the sycophants, Republicans are probably looking for any good excuse to distance themselves from the President and his “ahh-very large ahhh-brain”.

The trading patterns in the PM of at least three of the last six sessions made me suspect of similar activity as expressed in this post in our own markets. I really don’t have the expertise to definitively evaluate my suspicions . To be more specific I am looking at ETF actions. With the upcoming Election cycle motivation for this could well exist. Can anyone one shine some light on this topic? It does supply a small trading edge from time to time…

China’s economy is almost ponzi scheme ish. When in doubt add more debt. They are becoming less competitive. It is not sustainable. Sure they can last a while but ultimately the bills come due. When it implodes I do ‘t know but the next global downturn is going to be pretty tough and the options to deal with it are dwindling. Remember how housing prices never go down? I agree Trump will cave on trade, in fact it looks like it is starting. Xi will play him but as long as the optics are ok and Delusional Don can call it a win it will be done even if it puts us in the same or worse spot. It is about him not America. I can’t wait to get rid of these higher taxes (tariffs) Delusional Don put on Americans.