The Turkish lira came under renewed pressure on Friday after three days of gains and ahead of next week’s holiday in Turkey that will mercifully see local stock markets close.

Over the past several sessions, the currency recouped some of last week’s harrowing losses thanks to a $15 billion investment promise from Qatar, some ostensibly soothing rhetoric from Berat Albayrak and a crackdown on swaps which paradoxically weighed on equities.

“The recent limitations on swap and swap-like transactions have led a lot of funds in search of lira,†a trader at BGC Partners Securities in Istanbul told Bloomberg on Thursday, as stocks fell more than 3% in Turkey for the second consecutive session. The implication there is that funds were dumping stocks to raise lira. Volatility on the Borsa Istanbul has exploded to levels last seen during the coup attempt.

(Annotating the lira’s wild week)

The Borsa Istanbul is down more than 7% for the week. That makes this week the third-worst week since the coup attempt.

Meanwhile, Turkish banks are an unmitigated disaster. Have a look at the Borsa Istanbul Banks Index, which had its worst day since 2006 earlier this week:

(Turkish bank stocks collapse in 2018 amid currency crisis, political concerns)

Well, given Friday’s losses in the lira, and given that everyone has had a week to try and process what the impact of a meltdown in Turkey could be across markets, this is probably a good time to quickly run through a couple of notable pieces of research on spillover and contagion.

Obviously we’ve touched on this throughout the week, but again, it’s worth keeping apprised of the latest analysis on this, just in case things deteriorate further.

Front and center (in the media anyway) are European banks, with an emphasis on UniCredit, BBVA and BNP Paribas, all of which are reportedly on the ECB’s radar. Last Friday, one of the catalysts for the lira collapse was a Financial Times article that tipped the ECB’s concerns. That article sent the euro to a one-year low.

There have been all manner of notes out this week seeking to address this issue and on Friday, Goldman is out with perhaps the best of the bunch. The bank begins by noting the obvious, which is that CDS and shares of BBVA, UCG, ING and BNP have weakened markedly. CDS spreads for BBVA and UniCredit hit their widest levels since the late May turmoil in Italy, for instance.

(Bloomberg)

Shares of UniCredit and BBVA have plunged since Steve Eisman (of “The Big Short” fame) told Bloomberg he was shorting them due to their exposure to Turkey.

What’s the reality here when it comes to exposure for the European banking sector? Well, Goldman has this to offer in the note mentioned above:

Within our European coverage of >50 banks, 5 groups list Turkey as a meaningful exposure according to the transparency data published by the European Banking Authority (EBA). Notably, the affected banks remain relatively well diversified; although together they control roughly one-quarter of the Turkish market, their respective Turkish exposure stands on average at c.4% of consolidated EAD and loans. While BBVA screens as an outlier, we note that similar to Unicredit and BNP the Spanish group only holds a partial stake in the local business. For our coverage as a whole, Turkey accounted for <1% of total EAD in 2017 and c.1% of our Net Profit for 2018E (prior to revisions included in this report).

That doesn’t paint a particularly dire picture. A handful of names do control a large share of the Turkish market, but at the sector level, that exposure appears small and even among the exposed names, the balance sheet risk looks contained.

Of course that doesn’t account for the deleterious effect on sentiment that would invariably accompany a further deterioration in the outlook for Turkey. In other words, if things go off the rails in earnest, all bets are off.

For perspective, Goldman also notes that “total foreign claims of the foreign banking sector against Turkey stood at US$223bn as of the end of 1Q18 (of which Europe accounted for US$183bn), down from a peak of US$269bn at the beginning of 2016.” Here’s the visual on that:

(Goldman)

So that’s European banks. Obviously, the spillover risks for emerging market FX are large and we’ve seen that play out this week, especially in South African rand (see here), the Argentine peso (see here) and also the Indonesian rupiah (there’s some color on IDR in the linked post about the rand). As an asset class, EM FX has come under enormous pressure this year amid Fed tightening and idiosyncratic flareups in emerging economies. The last three weeks only added to the malaise.

(MSCI’s gauge of EM FX has fallen in 10 of the last 12 weeks)

On this, Goldman has a separate note out that takes a look at FX sensitivity to the lira. The results aren’t surprising, but they’re still worth noting.

“Average empirical sensitivities to Turkish assets are summarized in the leftmost column of Exhibit 1 [and] consistent with the idea that a sell-off in the Lira may make investors nervous about ‘similar’ assets, our metrics suggest that it is other EM high-yielders – in particular, the ZAR, BRL, MXN, RUB and INR – that are particularly exposed to weakness in Turkish assets”, the bank writes, in a note dated Thursday.

(Goldman)

This is a good time to remind you that there’s a self-feeding dynamic implicit in that analysis. Last weekend, for instance, we implored folks not to forget about Russia. If the sanctions push gains momentum and Congress decides to sanction Russian sovereign debt, the ruble would get hit hard, adding to EM FX woes, thus perpetuating and snowballing the lira spillovers.

Additionally, a lot of these currencies are commodities currencies and as noted on multiple occasions this week, commodities are in a dive. Oil is headed for its seventh weekly loss in a row and look at the Bloomberg Industrial Metals index:

(Bloomberg)

Again, this all comes back to the same problem, which is that an already precarious setup in emerging economies (see here) is colliding with i) hawkish Fed policy (a sapping of dollar liquidity), ii) concerns about global growth (thanks to the trade war), iii) an administration in the U.S. that’s increasingly prone to resorting to unilateral sanctions to punish “bad” actors on the global stage, and iv) idiosyncratic risk across certain EM economies, to produce something of a perfect storm for developing economy assets.

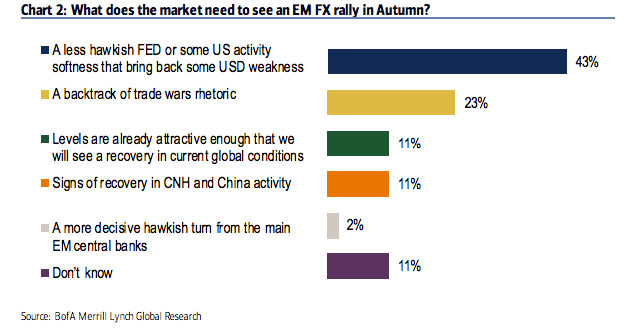

If you’re looking for an umbrella, the 64 fund managers with $335 billion in AUM who participated in the latest edition of BofAML’s FX and rates sentiment survey (conducted from August 3 through August 8), have a pretty good idea where to find one…

Four years ago it was thought the problem was there simply wasn’t enough oil to support the global growth narrative. So we produced more oil than ever before only to watch oil prices plunge, because the underlying problem was that there still simply wasn’t enough trusted capital available to exchange for it despite the QE rounds, UST issuances, and tax cuts. Too much too soon for the EMs, perhaps? China seems to think so.

Nothing’s really changed, yet. This is still a drought, not a storm. But sure, it’s easy to hallucinate when you’re dehydrated…

You can E all the Q you want but if it just goes into the stock market nobody can use it to buy anything. Wage growth is just beginning and the cycle is late in its days. Helicopter money sounds crazy but at this point I’m not sure how else you rebalance things. I suppose there is always waiting for inflation to go nuts but if there is anything apparent so far is it that companies are highly reluctant to raise wages for any reason no matter how good they are doing.