On Tuesday, reports suggested Steve Mnuchin is set to restart negotiations with Chinese Vice Premier Liu He, with whom the Treasury Secretary struck a short-lived trade “truce” back on May 19, after two days of talks in Washington.

That truce (which revolved around the prospect of China purchasing more goods from the U.S.) lasted all of about 10 days. Facing a backlash from the protectionist contingent and fearing Mnuchin’s “on hold” comments sent the “wrong” message to his base, the President abruptly changed course, refusing to grant further waivers to Canada, Mexico, and the European Union on the metals tariffs, and setting a deadline (July 6) for the imposition of duties on $34 billion in Chinese goods.

The deadline with China came and went and Beijing responded as expected. It’s been all down hill since then.

Over the past several weeks, with company after company citing the tariffs as a possible drag on profits and with the U.S. agricultural community recoiling at the prospect of effectively being put on government welfare, Trump has been at pains to convince America that this is all worth it. On Tuesday evening, at a rally in Florida, Trump told a characteristically raucous crowd that “everyone who greets him” tells him that “what he’s doing” with the U.S. economy is “the talk of the world”:

He’s right about one thing. His economic policies are indeed “the talk of the world”.

Well, as he was busy shrieking in Tampa, new reports suggested the administration is now considering upping the ante on China when it comes to the proposed duties on an additional $200 billion in Chinese goods. You’re reminded that Trump rattled markets on July 10, when the USTR published a list in conjunction with those prospective tariffs (we’ve republished the list in full below this post). Those tariffs would be on top of the levies on $50 billion worth of imports, taxes on $34 billion of which went into effect on July 6. Duties on the next $16 billion of goods are expected soon.

While it wasn’t surprising that the USTR published that list, it was rather alarming that the administration published it ahead of the imposition of duties on the next $16 billion in Chinese exports to the U.S. That seemed to suggest Trump was moving the time table up.

Last week, Trump told CNBC he’s “ready to go to $500 billion“, a reference to the idea that eventually, he’ll simply slap tariffs on everything America imports from China.

The problem for Trump (as detailed extensively in the first linked post above) is that thanks to the yuan’s rapid slide, China has already offset the effect of both the tax on the first $50 billion of exports to the U.S. and the prospective duties on the additional $200 billion. Here’s Goldman to explain:

About one-third of CNY changes pass through to export prices, which in turn affect exporters’ market share gains/losses. Our estimate there similarly implies that a 10% depreciation in CNY TWI could lead to a 5pp increase in exports, or 70bp in GDP, with roughly 3 quarters’ lag. Therefore, based on these estimates, the roughly 6% CNY TWI fall since the mid-June peak should map to a 40-50bp support to GDP, which would essentially offset our estimated direct growth drag from the first two rounds of US tariff measures (the 25% additional duty on $34bn+$16bn and 10% on another $200bn of Chinese goods), although the boost would probably be realized in full a few months later.

Unless Trump can engineer a sharp drop in the dollar, he’s effectively just running up the down escalator at this point.

So, what does the administration do? Well, see how Goldman notes that the expected tariff rate on the additional $200 billion in Chinese imports was 10%? Yeah, so Trump is considering taking that up to 25%.

“The Trump administration will propose raising to 25% its planned 10% tariffs on $200 billion in Chinese imports, ratcheting up pressure on Beijing to return to the negotiating table”, Bloomberg writes on Tuesday evening, citing three people familiar with the internal deliberations, before adding that announcing a higher tariff ahead of public hearings scheduled for August 20-23 “will send a signal that the Trump administration is upping the pressure on China to make serious concessions.”

Or it signals that Trump is desperate to get a “win” on trade ahead of the midterms.

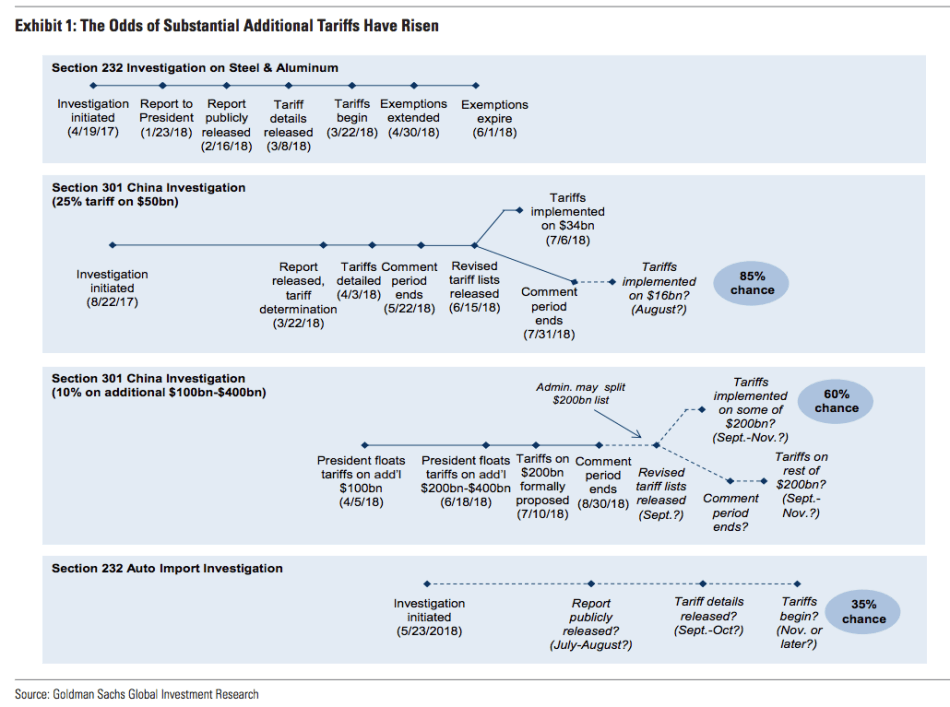

For those in need of a refresher, here’s a helpful infographic from Goldman that breaks down the various proposed measures and assigns probabilities:

(Goldman)

That visual is from two weeks ago, and as you can see, the bank had already upped the subjective odds of Trump moving ahead with duties on an additional $200 billion in Chinese goods to 60%.

“The composition of the list and the choice to impose a 10% tariff rather than the 25% in the first round suggests that the White House might believe these tariffs might ultimately take effect”, Goldman wrote.

If the 10% rate indicated the administration’s belief that they might actually go through with the tariffs on more goods, then one wonders what taking that up to 25% means. I suppose if you follow the same logic Goldman did in their assessment, it means that Trump might be bluffing. Or it could just mean Trump is belligerent.

Bear in mind, none of this even includes the proposed auto tariffs.

Godspeed, Steve Mnuchin.

List of goods

The list of goods is mind-blowing and it would have a significant impact on the US economy. We know that Trump really wants free trade with Asia on everything USA, but he is negotiating 1980’s style. Go figure.