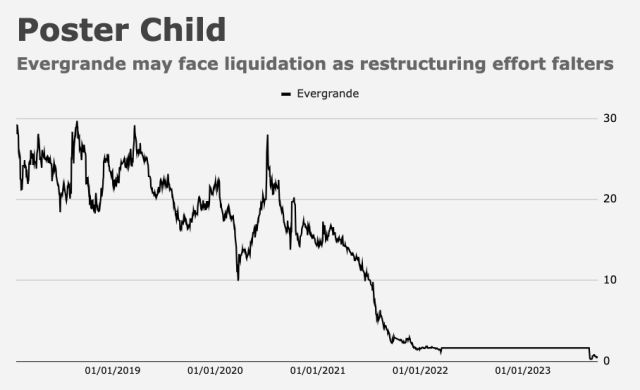

China’s property developers were back in the spotlight Monday, where that means they were shot to hell. Again. Blame meltdown poster child Evergrande.

I won’t regale readers with the tedious specifics, but the short version goes something like this. The ongoing property slump across the world’s second-largest economy imperiled sales assumptions embedded in Evergrande’s restructuring plan, while unspecified issues at a subsidiary raised questions about the company’s ability to issue new notes for the debt swap at the center of Earth’s largest corporate turnaround effort. (Evergrande defaulted in late 2021. Its liabilities exceed $325 billion. Obligations representing a fraction of that are tied up in lengthy, opaque resolution negotiations.)

Meetings with creditors scheduled for today and tomorrow were canceled last week, when Evergrande said the “current situation” made it necessary to “reassess” the terms of the restructuring. Support for the plan varied among creditor classes as of April, the last time Evergrande was kind enough to provide an update.

There’s no transparency, and nothing creditors can do. Bondholders have no real recourse on the Mainland (there’s no rule of law), but a Hong Kong court eventually put what amounted to a sell-by date on Evergrande’s belabored restructuring: The company has to prove it’s making progress towards a resolution by the end of next month. Or face liquidation.

Evergrande could’ve held a vote on the restructuring last month, but decided to kick the proverbial can to late September. Now, they’re kicking it again. Not only that, they’re suggesting that i) the terms might change, and ii) they may not be able to issue the notes for the debt swap. At stake: Some $30 billion of offshore debt stuck in limbo.

The shares (which started trading again late in August after being halted for a year and a half), plunged, although it’s hard to make out on the chart because a 20% decline following an existential collapse is a rounding error in the context of the pre-crash price.

Apparently, China’s securities regulator is investigating Evergrande’s mainland subsidiary for information disclosure violations. That’s not especially unusual, and under the circumstances, it’d be the furthest thing from surprising if Hengda Real Estate (the subsidiary) is indeed having a difficult time providing markets with timely updates.

This all comes on top of recent adverse developments at Country Garden, and amid concerns around a possible implosion of key players in China’s sprawling trust industry.

The timing leaves something to be desired. Chinese home-buying tends to accelerate in the lead up to Golden Week. Authorities in Beijing are at pains to bolster sales and recently relaxed various restrictions in an effort to shore up sentiment. Now, prospective buyers will grapple with whatever Evergrande headlines the Party lets Mainland media publish.

“Insult to injury” is accurate, but feels inadequate. If Evergrande can’t issue notes for the debt swap, they’d presumably have to propose exchanging $30 billion in offshore notes for stock. I’m not sure creditors would be enamored with that. (Would you want shares of Evergrande?)

Earlier this month, Chinese police arrested multiple people at Evergrande’s Shenzhen-based wealth management unit. Evergrande acknowledged what it described as “the imposition of criminal coercive measures on relevant personnel.”