“Divergent movements” on subindexes and across demographic cohorts left the headline University of Michigan sentiment print mostly unchanged in the preliminary reading for September.

Call it an offsetting tale, told by consumers, full of sound and fury, signifying a slight miss to consensus.

Economists — 55 of them — collectively wanted 69 from the headline. They got 67.7, an “inch” lower from August’s final reading, as the release put it.

Technically, this marked the second monthly decline. Survey director Joanne Hsu wrote it off to noise.

The current conditions gauge slipped nearly 8%, but Hsu noted that “short-run and long-run expectations improved modestly.” “On net, consumers remain relatively tentative about the trajectory of the economy,” she added.

Consumers aren’t concerned about a possible government shutdown, Hsu went on. Or at least not yet. They (consumers) have seen this movie before. It’s a bad film. Each sequel is invariably worse than its predecessor (Scorcher VI). But it’s never the end of the world, even as shutdowns are yet another testament to the governance concerns flagged by Fitch over the summer, following the debt ceiling standoff.

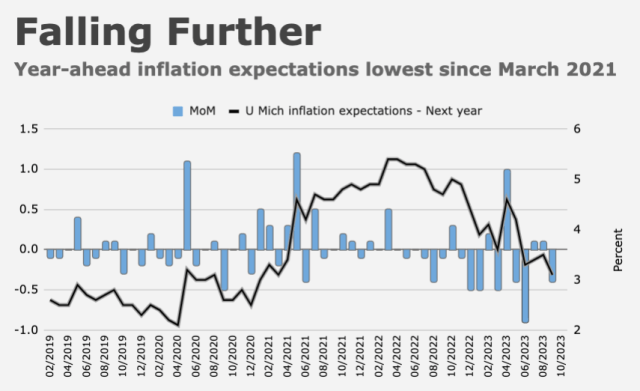

The big “news” (and the bar for that is low on Fridays) was the drop in year-ahead inflation expectations in the Michigan poll. At just 3.1%, that series is now the lowest since March of 2021. The “next five years” reading, at 2.7%, was the lowest in a year.

“Consumers have taken note of the stalling slowdown in inflation, but they do expect the slowdown to resume,” Hsu remarked. The readings were especially notable in the context of rising gas prices, which pushed up headline CPI last month.

“Oil [is] putting upward pressure on pump prices, but the rise is tempered by much lower demand,” Andrew Gross, a spokesperson for AAA said. “The slide in people fueling up is typical, with schools back in session, the days getting shorter and the weather less pleasant,” he added. “But the usual decline in pump prices is being stymied for now by high oil costs.”

Year-ahead expectations in the Michigan survey are now effectively back to pre-pandemic levels, and September marked just the second time that the longer run gauge fell below 2.9% since inflation accelerated in the spring of 2021.

“Rising gas prices are the likely culprit depressing [sentiment] yet rather bizarrely, we have some big declines in inflation expectations which should be music to the ears of the Fed,” ING’s James Knightley wrote. “The usual caveat applies that they use fairly small sample sizes and things can swing [but] on balance, this is further evidence that backs the Fed’s claims it can achieve a soft landing for the economy while returning inflation sustainably to target.”