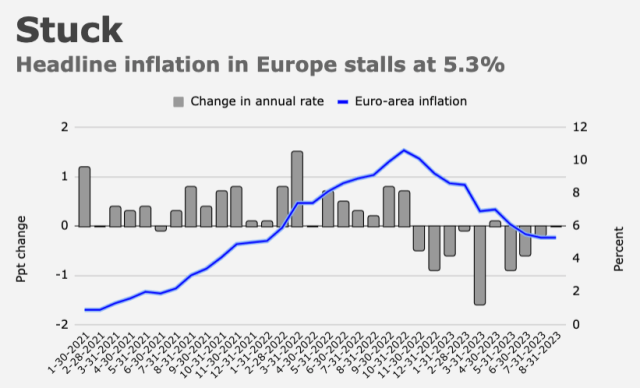

Headline inflation in Europe is stuck, apparently.

The all-items gauge loitered at 5.3% in August, data released on Thursday showed. Consensus expected a downshift to 5.1%.

It was just the second time in 10 months that the YoY pace of headline inflation in Europe didn’t recede.

Country-level prints out of France, Germany and Spain all overshot expectations for August. In France, the re-acceleration in the headline gauge to 5.7% was particularly concerning. That was 0.3ppt ahead of estimates and the briskest pace since May.

Thursday’s initial read on bloc-wide inflation for August wasn’t a disaster exactly, but it’s suboptimal, and not just because 5.3% is nowhere near target. Outside of inflation, there’s ample evidence to suggest the monetary policy transmission channel is working in Europe, which is to say additional rate hikes probably risk amplifying the slowdown evident in recent PMIs.

Recall that the composite gauge of overall business activity published by S&P Global printed 47 in the preliminary read for August, a 33-month low and the worst in a decade if you exclude the pandemic. Germany is mired in a multi-quarter quagmire. Long story short, Europe is experiencing stagflation. Additional rate hikes could exacerbate the growth drag with little to show for it on the inflation side.

That said, the good news on Thursday was a downtick in core inflation and also services inflation. The former ran at 5.3% this month and the latter 5.5%.

Note that the 5.5% pace for services still counts as the briskest on record outside of the prior month’s 5.6% reading. Suffice to say “good news” is relative.

The September ECB meeting is live. Market pricing reflects about a one in three chance of another hike. The Governing Council’s hawks are pretty clearly on board, even as the likes of Isabel Schnabel concede that the bloc’s growth prospects are “weaker than foreseen.”

“For the ECB, these August inflation data were among the most important data points ahead of the Governing Council meeting in two weeks,” ING’s Bert Colijn wrote. “While inflation remains stubborn enough to make ECB hawks uncomfortable, it does look like a further deceleration is in the making [but] given the ECB mantra over recent months that doing too little is worse than doing too much, we still expect another 25bps rate rise, despite this being a close call.”

The concern, obviously, is that the elevated (and very sticky) core and services inflation readings in Europe are indicative of a price growth impulse that’s now embedded in wage-setting and expectations, thereby setting the stage for a self-fulfilling prophecy.

Schnabel underscored such worries in a speech on Thursday. “Underlying price pressures remain stubbornly high,” she remarked, in text of an address for an event organized by the Center for Inflation Research. “Domestic factors [are] now the main drivers of inflation in the euro area.”

Do you mind writing an article explaining the causes of Europe’s stagflation and maybe compare and contrast versus the US? I know the Europe has been in a secular stagnation for over a decade but not certain what the main reasons are.