It’s not a recession.

It can’t be. The labor market is too strong. The midterms are too close. And the Fed still needs to squeeze in another 100bps worth of rate hikes by year-end.

You can write your own dark jokes. There are plenty. And attempts on the part of analysts, economists, administration officials and monetary policymakers to explain away a second consecutive quarterly contraction in the world’s largest economy will invariably backfire. Sundry “explanations” will only serve as more fodder for those inclined to sarcastic derision.

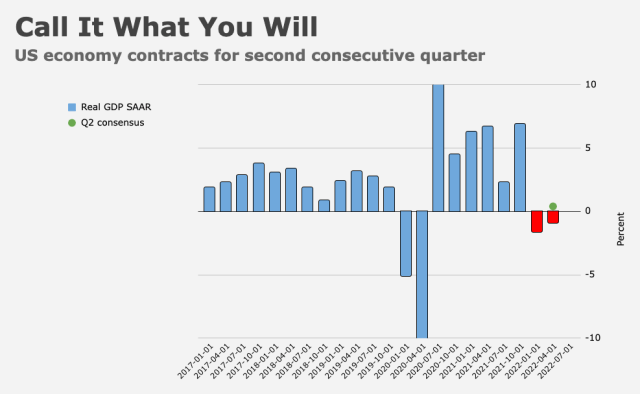

The US economy contracted at a 0.9% annual rate in Q2, hotly anticipated data out Thursday showed. On the conventional, if not official, definition, the US fell into a recession last quarter (figure below). The yield curve’s reputation for prescience is intact.

For the better part of a month, the Biden administration was at pains to explain to the public that a recession isn’t a recession — that the NBER, the official arbiter, is extremely unlikely to brand Q1-Q2 2022 with an “R.” Those efforts came too late.

Since Q1’s contraction, I’ve variously suggested the White House and the Fed would do well to expect the worst and hope for the best. Officials could’ve endeavored to take the edge off by socializing the message relentlessly over three months — if the American public can become desensitized to tragedy, it couldn’t possibly be too difficult to talk them to sleep with a dull, definitional debate about economics.

Of course, a sensationalized press and divisive politics meant that even if officials, both at the White House and the Fed, were successful in convincing the public that there’s no set definition of “recession,” opportunistic media outlets and politicians clamoring for “points” (figurative and literal) ahead of the midterms, meant a contractionary read on Q2 GDP would be presented as a recession regardless. So, maybe there was no point in preempting it with a PR campaign.

Notably, the personal consumption component in the advance read was a miss. The 1% gain was short of consensus (figure below) and when considered with a sharp downward revision to Q1’s print in the final estimate of first quarter growth, it’s plain that the American consumer is faltering in the face of onerous macro circumstances, including and especially elevated prices for food and gas.

Outside of the pandemic-inspired plunge in 2020, Q2 2022’s personal consumption print was the lowest since the first quarter of 2019, a period impacted by the longest government shutdown in US history.

Along with labor market strength, the notion that US consumers are “resilient” thanks to “excess” savings and accumulated pandemic “buffers” is the cornerstone of any constructive take on the outlook for the economy. I employed quite a few scare quotes in the preceding sentence — they serve a purpose.

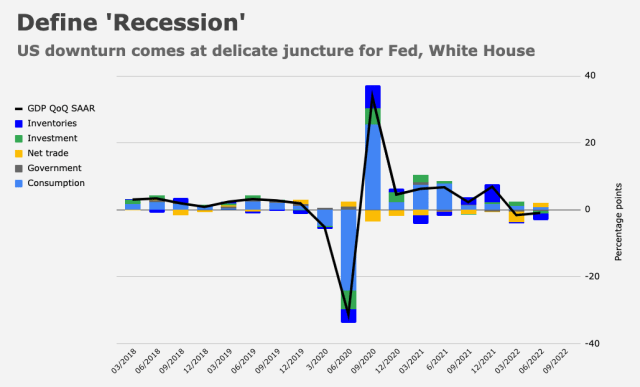

Business spending contracted in Q2, Thursday’s advance read suggested. Nonresidential fixed investment (spending on equipment, structures and intellectual property) fell 0.1% over the quarter, following a robust increase in Q1.

It was the first decline since the pandemic months (figure above).

Residential investment crumbled amid rate hikes and a rapidly cooling property market. The 14% drop was nearly half as large as the decline accompanying Q2 2020’s depression-like economic collapse, and counted as the second largest decline in a dozen years.

Government spending fell for the third consecutive quarter. Federal, nondefense government expenditures decelerated at a double-digit rate. Notably, final sales to private domestic purchasers were unchanged in Q2. That’ll likely raise eyebrows.

Th breakdown (below) shows inventories were the biggest drag. Personal spending’s contribution was minuscule. Trade was the only real boon.

“The growing skepticism that the Fed will continue to deliver aggressive tightening has been emboldened by this morning’s numbers,” BMO’s Ian Lyngen remarked.

And yet, the Fed’s hands are tied. PCE prices rose 7.1%, the same as Q1, while core PCE, at 4.4%, remained very elevated even as it decelerated from Q1’s pace, in line with estimates. The GDP price index rose 8.7% in Q2, far more than expected and up sharply from 8.2% in the first quarter.

All in all, the numbers were poor. It was very difficult to find a silver lining or otherwise spin the report as something other than a disappointment. It suggested the economy is slowing where it counts, so to speak. Personal consumption is decelerating and investment is slowing.

Of course, that’s precisely the point if you’re the Fed. Policymakers are attempting to engineer a slowdown. The question is whether they’ll overshoot. Controlled demolitions are difficult to manage.

As Jerome Powell noted during Wednesday’s post-FOMC press conference, demand clearly slowed in Q2. He juxtaposed the situation with the more ambiguous conjuncture that prevailed in Q1, when the economy contracted on paper but many analysts waved the negative print away as meaningless. Even that position was made less tenable when the final read on first quarter growth included a large downward revision to the personal consumption component.

“You pretty clearly see a slowing in demand in the second quarter,” Powell told reporters. “We think demand is moderating. How much is it moderating? We don’t know.”

Now we do know. Or at least we have an estimate of how much “moderation” took place last quarter. That estimate is subject to revisions. A couple of them. It’s also subject to political spin, which will begin posthaste.

Don’t us the “R” word. It’s not a recession. Not yet. And not officially.

I would take that bet- Don’t think there is 100 left in the bag. You can argue we are not in a recession- it is semantics now in my view. The economy is slowing quickly. You can call it whatever you wish. As you said to me, the numbers are the numbers…..

4% or 5% inflation isn’t a sustainable state of affairs. To reiterate: Inflation has to (must) come down closer to 2%. The Fed understands this. And hopefully, they’re prepared to do whatever’s necessary to achieve that. The problem here (and I’ve said this again and again) is that an already disaffected populace cannot (and will not) countenance 5% inflation over a long period of time if labor (as an economic actor) loses whatever small bit of leverage it managed to reclaim post-pandemic. Here’s what will happen in that scenario: Wage growth will trail inflation by a wide margin, further inflaming societal tensions until eventually, another populist takes control of the White House promising to fix the situation. This is like climate change — we won’t notice it until it’s too late. You can’t have (or even risk) 5% inflation in perpetuity if there’s even a small chance that growth will be subdued over the same period and labor is powerless vis-a-vis capital. You’ll have social unrest. If it takes a deep recession to prevent that, then so be it. Everyone will understand this belatedly when it’s 2025, inflation is 5%, growth is anemic and worker strikes are a fixture of the economy, along with street protests.

It sure looks like the Fed and, by extension the WH, are blaming labor for the current state of inflation. This has been an overly spun narrative for some time now that, begs some discernment because, it seems to have an objective. If Biden falls for this trap he all but assures voters will continue turning on him and his party for the alternative who will no doubt be promising to fix inflation without harming voters.

I agree that QT is necessary to stave off global inflation, but let’s stop victim blaming here. Lower income taxpayers need some assistance to ride out this storm. Congress is sitting on their hands hoping that voters will ignore the pain they are putting them through with their inaction.

Oh and by the way, can we PLEASE abandon the two party system now? Obviously two parties are not enough to avoid the democracy death spiral the United States is currently in.

I hate to agree with our dear leader but a quote from Ron DeSantis supports his warning about inflation helping enable a smart populist leader:

“We’ve got to start putting the people first over the ideology of the ruling class and the governing elites.” DeSantis said at an event last month.

Olivier Blanchard respectfully has a different take. He, and I also do not think 2% is some magical number. What makes 2% the number (because Alan Greenspan the failed Fed chairman said so?) ? Blanchard has suggested 3%. I think Australia has also targeted 3% fairly successfully in the past. In any case if the economy keeps slowing, 2% is not going to be much of a problem. I am currently trying to sell an apartment in NY- the bid side is dropping like a stone and my realtor reports the only activity there now is broken contracts. I keep hearing adds for incentives for cars on the radio too. And retail is reporting a bulge of inventory. Out where I am on Long Island right now, gas prices have dropped ~$1 a gallon in the last month. We shall see what the inflation numbers bring in the next couple of months but based on what I am seeing they are going to be a lot lower in the next 3 months- notwithstanding the lag from owners equivalent rent. Social upset was baked in the cake no matter what Joe, Congress and Jay did- the economy has taken not 1 not 2 but 3 major supply shocks in the last 2 years. First it was unemployment and pictures of average Joe and Jane waiting in mile long ques in their cars for food handouts and depression in employment. Now average Joe and Jane and above average Joe and Jane are suffering from real wages declining. I watched Jay Powell’s conference- he was decidely neutral on the path of monetary policy. I think the bond market jumped the gun a bit, but the talking head Fed watchers were probably caught out also- he was not totally hawkish either. Take Powell at his word – the Fed is watching the stats and making decisions meeting to meeting. The best thing market observers can do is try to figure out the economy- if you do that you will probably figure out the path of short term rates.

Relax, hours worked per week and productivity growth are both going down and therefore we are in a recession and there’s no argument to suggests otherwise. Furthermore, Treasury yields are falling fast, as GDP declines, indicating demand destruction phasing in. Earnings revisions will quickly be linked to layoffs and inflation will soon spin downwards in a deflationary spiral that will collide with the impacts of Putin Euro crisis by Christmas. Whipsaw volatility will be offset by passive buy the dip momentum that takes us into slow global growth and an investible future. Amen

I thought bonds had a little further to fall before they are interesting, but maybe we are there…

Getting there, for sure.

In defence of not calling it a recession yet is the fact that so far most people who want a job can find one. That’s what is important to most people (followed closely by the requirement that that job pay a decent wage).

On that second point, is there a scenario where wages for the average worker exceed inflation for a reasonable period of time? Where the poor can get even a little bit richer?

I’ve read that peasants were able to command higher wages after the Black Death.

I’ve heard the poor can get richer if they privatize Social Security and put it all in the stock market, at least that was the plan circa 2007…

Isn’t this the definition of “soft (ish)”? IE arguing over wether it is or isn’t? The Fed now has your attention. Continue forward with measured steps vis a vis interest rates. Heck, pause even. The sword of Damocles is QT. Don’t show your hand.

The Fed’s mandate is not … make money for traders (?), the one percent (?)…

YOU, H, HAVE MADE A CASE FOR THE COLLATERAL EFFECTS OF THE FEDS RESPONSE TO THE GFC. You have at least implied that the response to the GFC was only and always going to benefit the wealthy. That that outcome was or should have been known. You wring your hands (spill gallons of eloquent digital ink) over inequities and then you worry the direction of finance. I know, I know, because it’s effect on the little guy. I am struggling with this… notion… IT WAS EVER AND ALWAYS THUS.

Both sides of the coin are TAILS!

At various times and unevenly Capitalism provides luck as THE safety valve for social cohesion amidst …progress(?).

The present conjuncture (your word) is the answer to why notions of MMT for social justice don’t work.

In many ways the current moment feels like collectively facing the economic questions that were sidestepped by offshoring the American economy in the ‘70’s.

We do kick the can down the road.

This comment is indicative of why media coverage invariably ends up biased and polarized. Actually presenting both sides of the issues (as opposed to just pretending to) and arguing both sides convincingly prompts readers to suggest the coverage is inconsistent — “you, yourself have made the case!”, etc., etc.

Yes, in fact, I “myself” have made the case. All cases, in fact. I can argue all sides of every case, and that’s precisely what I intend to keep doing in perpetuity, except in instances where one side is tantamount to geopolitical propaganda (that caveat isn’t generally applicable to daily coverage of domestic macroeconomic outcomes, but I think it’s important to include it — you’ll never find me parroting Kremlin talking points, for example).

The truth is, almost nobody really wants to hear both sides. People want one side or, at the least, a one-sided (i.e., biased) interpretation of both sides. For most people, the internet is little more than a place to source endless confirmation bias.

If you get confirmation bias from me, it’s by accident. Because to be totally honest, I’m a dispassionate observer. Precisely none of this affects me in any way, shape or form. Longtime readers know that, and it’s why people trust me. There’s no agenda here. None at all. That’s the most compelling pitch I could ever make for this site.

The post MMT pandemic collision with Putin Ukraine warfare is somewhat of a new place for capitalism to be in.

The potential dark winter ahead for Europe will be among the most significant challenges to capitalism, ever. Putin is literally going to experiment this winter to determine how much rope is needed to hang the West.

It remains to be seen what role QE, QT or MMT will play if all of Europe literally freezes. My hunch is, nobody is preparing for that shock, especially since so many people globally are waiting to BTFD, but obviously, this is priced in.

Nearly everyone (including, unfortunately, MMT’s biggest names) seems to mischaracterize what MMT actually is. They need to find a new name for it. It’s not “modern” and it’s not a “theory.” It’s just how government finance works in advanced, developed economies with sufficient monetary sovereignty. That’s all. MMT is not precisely the same thing as prescriptive exhortations to fiscal-monetary partnerships aimed at solving various societal problems. MMT, as it’s currently expounded by the biggest names associated with it, is a descriptive explainer on the sequencing of borrowing, taxing and spending. That’s really all it is. And when conceptualized like that, it’s not really debatable. I used to charge critics with erecting straw men to attack MMT, but eventually it occurred to me that nobody — not critics, not proponents and not MMT economists either — actually know what MMT is. So I stopped talking about it. Because, again, there’s nothing to talk about until the MMT crowd goes on the offensive by adopting a prescriptive action plan based on what, for now, is just a description of government financing.

Inflation, too, is not really a “thing.” Rather, it is a descriptive term summarizing actual real world behavior. To beat it one should be attacking the individual areas of price behavior which are not in compliance with the desired stable state.

Good job of level-setting in each of your comments above, H. And I like the MMT perspective. MMT is an abstract representation, a series of letters not clearly defined. It will become useful and relevant, or it will not, depending upon the practical value it enables.

Oddly, the MMT discussion above reminds me of the Biden administration’s approach to governing: Their rhetoric seems to be abstract and less than useful until now. But I note that they must have shared some precise language with Joe Manchin. Suddenly there are constructive bills going to the Senate floor for a vote. Whatever is happening behind the scenes, I hope it proves to serve good purposes.