There was more good news on the economic front in the US on Friday.

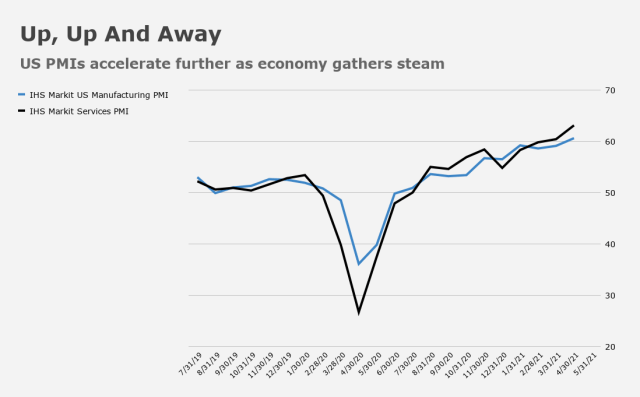

IHS Markit’s flash PMIs for April were buoyant, even as the manufacturing gauge printed a (very) slight miss.

The factory survey came in at 60.6 in the preliminary read versus consensus of 61. The services index hit 63.1 compared to the 61.5 the market expected. At 62.2, the composite gauge was the highest on record in data back to October 2009.

The breakdown was just a hodgepodge of superlatives. In addition to printing the highest ever on the headline, the manufacturing gauge came packaged with the best new orders print in a decade.

Predictably, price pressures were evident, to put it nicely. Input prices rose in the manufacturing survey and an index of prices charged for the services sector expanded for an eleventh month to the highest in series history.

“US private sector businesses registered a survey record expansion of output during April, as looser COVID-19 restrictions and strong client demand boosted business activity,” IHS Markit said, in the accompanying color. “A steep upturn in manufacturing production occurred despite unprecedented supply chain disruptions, while services activity growth hit a new high.”

Chief Business Economist Chris Williamson characterized the US economy as “firing on all cylinders.”

“The upturn is broad-based: The service sector is growing at the fastest rate recorded in almost 12 years of survey history, and manufacturers reported one of the strongest expansions seen over the past seven years [despite being] throttled by unprecedented supply chain delays, a consequence of which was a further steep rise in prices,” he went on to remark, adding that “the worsening supply situation is a concern for the outlook, especially in relation to prices.”

The updated “state of the union” visual (above) will soon need to have the left y-axis recalibrated.

Meanwhile, new home sales printed a huge beat for March. The annual rate rose almost 21% to 1.021 million (figure below). That beat all estimates (60 of them, to be precise). The median guess was 885,000.

Revisions added 163,000 to the previous three months.

The median price hit $330,800, and months’ supply dropped sharply to 3.6 from 4.4 in February, when winter weather was a drag. Backlogs hit the highest in 15 years (figure below).

If you were wondering whether the locales hit hardest by storms in February rebounded, they did.

Specifically, new homes sold in the South census region jumped 40.2%. That was the largest monthly gain since May of 1980 when, as far as the Robinhood set knows, Diplodocus still roamed the mid-west.

I have re-read some of H’s posts on the media and I am prepared for Wallstreet , in cahoots with the Media, to do anything to “rock the boat”- only way they can even try to beat SPY.

Take a position, call their favorite newsgirl(guy), publish a story, get out of their position. Good luck!

Meanwhile, I will hold my position in the stock market in the greatest country in the world and work on my hiking up the Colorado Fourteeners.