Recep Tayyip Erdogan asked for it, and he got it.

Assets in Turkey were besieged Monday as the market delivered its verdict on the Turkish autocrat’s decision to oust CBT Governor Naci Agbal last week.

Agbal’s dismissal was a flagrant assault on monetary policy credibility, a scarce commodity in Erdogan’s Turkey. The brazen move represented nothing short of an open-handed slap to the face to anyone who was inexplicably inclined to trust Erdogan in November, when he installed Agbal with the aim of halting a meltdown in the lira.

Read more: In Potentially Disastrous Move, Erdogan Fires Another Central Bank Governor

On Monday, the currency erased a chunk of the gains logged under Agbal, who delivered 875bps of tightening in his five months on the job.

The currency was already on the back foot amid the backup in US yields, and Agbal’s hike (last Thursday) was designed to help offset that. Now, it seems likely that the lira will hit a new all-time low in relatively short order. At one point Monday, it traded all the way through 8.47.

“We thought we had been wrong calling for a hold against a unanimous consensus that expected tighter rates only two days ago. It turns out we were not,” TD’s Cristian Maggio said. “Erdogan had not approved the move and, therefore…”

You know the rest. It’s astounding that Agbal would brave hiking against Erdogan’s wishes, let alone a hike that was twice the size of what the market expected. Perhaps he decided to go out with a bang, but he surely knew that defying Erdogan was guaranteed to be met with a furious backlash. With apologies, Turkey is not a democracy. It isn’t advisable to defy Erdogan. Not on monetary policy and not on anything else either.

“We think this means a sharp increase in volatility both in rates and currency. The lira can easily selloff 10-15% in a matter of days,” TD’s Maggio went on to say, adding that while CBT can perhaps control the front-end of the curve, “conversion flows by domestic investors and savers moving TRY into USD will exert constant, upside pressure on USDTRY.” An engineered squeeze on shorts is likely.

Turkey CDS surged the most on record, climbing to 472bps. “Options traders see almost a 60% chance that the lira will weaken this year past the record closing low of 8.52/USD reached in November,” Bloomberg’s Netty Idayu noted, adding that “one-month risk reversals on the USD/TRY pair have jumped by the most since 2006 [while] overnight implied volatility more than quintupled.”

Stocks in Turkey were an absolute mess. The Borsa Istanbul dropped more than 9% (figure below).

The exchange warned investors to “act in line with regulations,” which I assume is a euphemism for “please stop selling.”

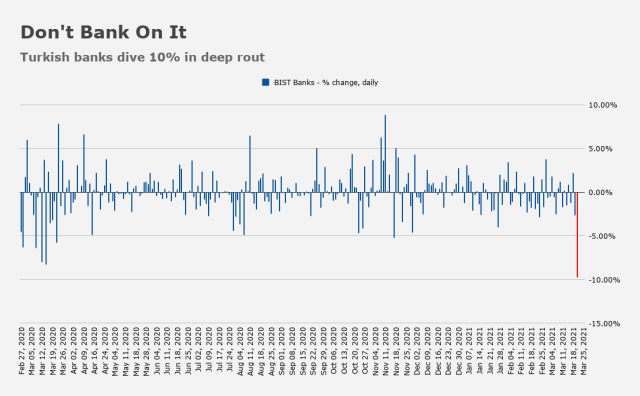

10-year yields jumped a harrowing 319bps. The banks index fell 10% (figure below).

“Agbal’s dismissal leaves Turkey beyond the point of no return,” SocGen’s Phoenix Kalen wrote. She expects “dollarization and currency interventions to resume,” and also cautioned that due to “the shortage of FX reserves, we may see more financial regulatory intervention.” Kalen said foreign investors “will exit Turkish assets [and] Turkey may soon be headed toward another currency crisis.”

Regular readers know I only speak definitively when I think I have a solid leg to stand on. I have repeatedly cautioned market participants to be wary of any analysis around Turkish assets that doesn’t explicitly acknowledge Erdogan’s almost cartoonish penchant for autocratic bellicosity. He’s a dictator. Period. And he isn’t going to change his mind about monetary policy.

Failure to grasp or otherwise come to terms with that simple reality leads strategists and even some seasoned EM investors (some of whom boast years of experience in Turkey), to persist in a state of willing disbelief. That was on display Monday in some of the quotes rolled out by the financial media.

In any event, I don’t know TD’s Cristian Maggio, but based on the notes I’ve read, I can say that he’s one person who does seem to grasp the reality of this situation.

“Monetary policy in Turkey is not set up to control inflation,” Maggio went on to say, in the same noted cited above, adding that,

It is a pure function of the pro-growth inclinations of the government. It also responds reactively (and usually with a strong lag) to uncontrolled currency weakness. Which means the implicit mandate of a CBRT governor is not to achieve 5% inflation, but to make sure that the credit impulse remains in place, while avoiding a collapse of the Turkish lira.

That’s it. Right there. That’s reality.

State banks attempted to support the currency Monday. They were “overwhelmed” by the “rush” to sell it, one FX trader familiar with the transactions told Bloomberg.