I don’t know if I’d call it “trepidation.” At the risk of trafficking in nebulous clichés, markets were in “wait-and-see” mode to kick off what promised to be an eventful week.

Activity data out of China for January-February was ostensibly robust, but it was exceedingly difficult to separate signal from noise.

Chinese equities fell more than 2% as investors continue to fret over liquidity. 100 billion yuan in MLF merely rolled maturing funding. As ever, the market wanted more. “The MLF amount just offset maturity, indicating PBoC’s tightening intention,” one regional economist said, adding that “since the start of this year, the PBoC has net drained over 600 billion yuan in funds from the market in order to curb asset bubbles.”

Tencent suffered another big hit amid worries Beijing is poised to give the company the Jack Ma treatment. The shares are down around 8% in two sessions.

This is another manifestation of governments tightening the screws on big-cap tech. It’s the “hubris bear market.”

Elsewhere, European travel and leisure shares surged. Believe it or not, the Stoxx 600 Travel & Leisure Index was on track not just to wipe away pandemic losses, but to close at a record high.

That, despite Europe’s ongoing troubles with vaccine distribution and difficulties exiting pandemic protocols.

You could just chalk it up to the ECB, which promised to pick up the pace of asset purchases at last week’s meeting. But it’s more than that. “The DAX hitting new records while the FTSE MIB advancing to 2021 highs last week captures the bullish undertones across the continent,” Bloomberg’s Laura Cooper wrote Monday. “The latter even as Italy enters another lockdown. That’s as stocks levered to reopening economies are set to gain even as virus risks linger,” she added, noting that outperformance from travel and leisure “shows the risk tolerance of investors seeking deep discounts and betting on growth prospects against a backdrop of ongoing policy accommodation.” I couldn’t have said it better myself.

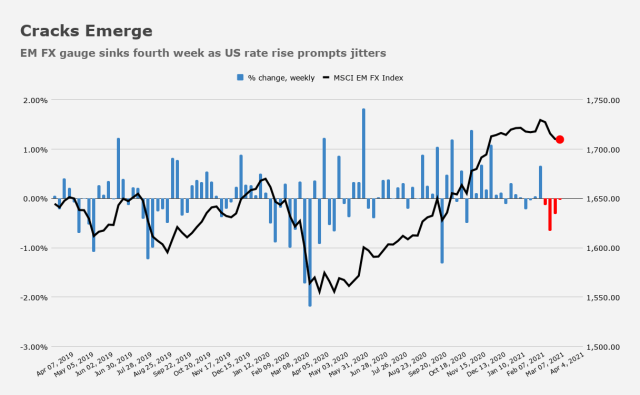

In EM, rising US rates and the usual hodgepodge of idiosyncratic factors are beginning to weigh. MSCI’s gauge of currencies is now in its longest run of weekly losses in 19 months.

The market will be looking for rate hikes and other measures to help inoculate (sorry) developing economies in the event US yields continue to press higher, perhaps dragging up the dollar in tandem. Dollar-denominated EM debt is mired in its worst run in a half-decade.

“The FOMC will talk dovishly but probably won’t do anything to directly help the long-end,” SocGen’s Kit Juckes wrote Monday. “So, no cavalry to the rescue for bonds. If markets can get through Wednesday without bonds taking another bath, the dollar’s bounce may start to run out of steam,” he said.

Meanwhile, the media’s attention now turns to Joe Biden’s next stimulus push which, we’re told, will be even larger than the $1.9 trillion bill passed last week. As Bloomberg reported, citing unnamed sources, the planned longer-term economic recovery package provides “an opportunity not just to fund key initiatives like infrastructure, climate and expanded help for poorer Americans, but also to address what Democrats argue are inequities in the tax system itself.”