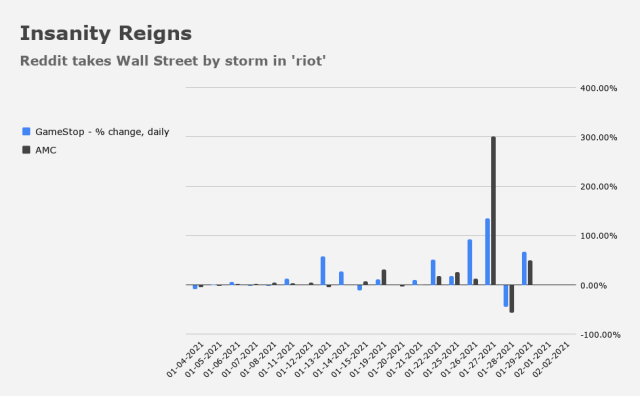

One of the most ridiculous weeks in recent memory ended with a flourish, as US equities careened lower, turning negative for 2021 in the process.

By Friday afternoon, most pundits had exhausted the thesaurus. Synonymous for “absurd” were all used up.

This was the week when populism came for the stock market, aided and abetted, ironically, by billionaires. “You can’t sell houses you don’t own. You can’t sell cars you don’t own. But you can sell stock u don’t own!?,” Elon Musk tweeted, feigning incredulity. “This is bullsh*t – shorting is a scam.”

Power to the people. Courtesy of the richest man on the planet. Who just happens to harbor a legendary grudge against shorts. A farce within a farce.

Equally ironic, the Reddit crowd’s usurpation was briefly short-circuited Thursday by Robinhood and other retail platforms that ostensibly aim to democratize the once exclusive world of finance. Lawsuits were filed. Congressional hearings are planned. Everyone took their turn playing the victim. Personal responsibility was nowhere to be found.

“[The] flashpoint between r/WSB and short-selling hedge funds [is] another escalation in The War on Inequality,” BofA’s Michael Hartnett said.

“Our secular view is inequality can only end via higher wage inflation for [the] poor and wealth taxation for rich,” he added, cautioning that “regulation aimed solely at new investors will simply sustain [the] bull market in anger.”

On Friday, the SEC attempted to strike an impossible balance, pledging to protect retail investors both from themselves and from efforts to curtail access to trading, while simultaneously cautioning the same investors to be conscious of their own behavior.

Ultimately, it was the worst week for stocks since late October. The S&P fell more than 3%, as did the Nasdaq 100. It’s no secret why. The Russell 2000 logged a fifth consecutive daily loss Friday, taking small-caps’ decline for the week to almost 5% (figure below).

Bitcoin (and Dogecoin, because why the hell not?) surged Friday thanks to Musk. Dollar-Libor dropped to a record low while interbank rates in China surged — funding feast versus famine.

The VIX jumped the most on a weekly basis since June (figure below).

Rates ended up being a side show, despite 10-year yields testing 1% (on the downside). It’s ironic (how many ironies is that now?) that rates were relegated to the back burner. After all, this was a Fed week and also GDP week. Additionally, one might have expected headline hockey around Joe Biden’s stimulus package to play prominently.

“The price action in a small subset of single-name stocks have been the show stoppers of late,” SocGen’s Subadra Rajappa said. “As equity indices declined, the uncertainty premium benefitted bonds [while] uncertainties around the timing of additional fiscal stimulus, squabbles over vaccines, and a dovish Fed were additional factors that weighed down the 10-year yield to 1%,” she added. “With the Treasury refunding announcement next week and more long-end supply in the coming weeks, we expect the 10-year to remain in the 1.0-1.20% range in Q1.” Treasurys fell Friday, eliminating the last vestiges of what was a weekly gain (figure below).

“Despite the week just passed containing several top tier fundamental inputs, the macro backdrop and shape of the recovery remain tied to the path of the pandemic and progress on the drive toward herd immunity,” BMO’s Ian Lyngen and Ben Jeffery wrote Friday afternoon. “With 21.7 million people having received at least one dose of the COVID-19 vaccine, we’re reminded that a 6.6% inoculation rate domestically leaves a mask-less reality at least several quarters away,” they added, noting that “the more extended the period that business activity is beholden to virus-mitigating measures, the greater share of temporary job losses will become permanent.”

Johnson & Johnson on Friday said its single-shot vaccine produced robust protection against the virus in a late-stage trial. It prevented two-thirds of moderate to severe cases, 85% of severe infections, and 100% of hospitalizations and deaths. “If you can prevent severe disease in a high percentage of individuals, that will alleviate so much of the stress and human suffering,” Anthony Fauci remarked.

Meanwhile, Andrew Cuomo plans to reopen New York City indoor dining at 25% capacity on Valentine’s Day. The city’s positivity rate fell below 5% by Thursday, a sharp decline from over 7% early this month. Pressed by restaurants who worry that 25% capacity isn’t even close to sufficient when it comes to rescuing their businesses, Cuomo said simply, “Look, 25% is better than zero.”

While fatalities nationwide remain tragically high, cases are falling rapidly (figure below).

Despite having spilled gallons upon gallons of digital ink documenting this week’s dramatics in real-time, it feels like there should be more to say.

Ultimately, though, I’m not sure there is. The financial media wrote the same story over and over again, until, finally, it went national as The New York Times, CNN, and others jumped aboard. The Reddit crowd was heralded as courageous usurpers one minute and derided as gamblers and amateurs the next, sometimes by the very same outlets.

I just have one question for every would-be populist, small government, libertarian commentator who spent much of the last nine months suggesting that the Robinhood / Reddit crowd was squandering everyone else’s tax money by speculating in stocks: Are those traders freeloading degenerates that don’t deserve a stimulus check or are they heroes who toppled the establishment?

Or is this just like every other narrative? That is: Subject to change depending on what generates the most clicks.

None of the above in my Bio. I will add that I did not predict most of this but when observing the action I can say that these are all (probably unintended ) consequences and there is much more to come. No system can constantly move the goalposts ,change a large percentage of the rules and then take a disclaimer on the inevitable result.

I’m with the clickbait explanation. Considering that rage capital for Donald Trump is virtually spent. Another object of rage is needed to generate clicks.

Many of the same people that have been clamoring for the reintroduction of wolves in Yellowstone are now calling for the death of bears on wall street. What they don’t realize is that they serve the same function. Overgrazing by ungulates of any subspecies will destroy the entire ecosystem. The ecosystem supports all life whether it be fiscal or biological. Once Blackrock and the other predatory hedge funds, operating behind the cover of Robin hood, destroy the equilibrium of price discovery we will have a short term euphoria before the entire financial system collapses. But once again they will blame it on folks that just wanted a really tasty avocado toast.

I was cleaning out my desk last weekend and found some old E*Trade statements from 1998, 1999, 2000. I sat back in my chair and unfolded the faded statements with a wry smile. Just what exactly what was I trying to prove back then?

I obviously had no idea. I just knew I was onto something much like the Redditors and quickly found out (the hard way) the mirage had a wry smile of its own. Beginning to wonder if that same mirage awaits in this case – or is this time different? Anything goes I suppose.

One would think after seeing guns drawn inside the Capital building that I would be shocked by this week’s events. Instead I just sat back in my chair and watched the after hours volume on GME tick faster than the debt clock. Anything goes…..

This afternoon when I left the house and wrapped the frayed white mask cord around my ears I was once again reminded….Anything goes……….

Monday morning will start like the 100 did before it, coffee, Bloomberg, an email or two, a glance out the bay window wondering how to position for what lies ahead. Down Friday + Down Monday? And if so, what will that mean in this (new) environment? Who knows. Anything goes.

So I am 100% with you when you feel like there “should” be more to say – but there isn’t.

Just remember when you light up on the deck in the Monday mist, at some point during the day many of us will be right back here to make sense of it all.

No pressure right?

Anything goes.

H-Man, it appears Robinhood is going to the gallows unless the Merry Men rally to save the day.

Millenial and GenZ money will move from Robinhood to Sofi app, I do think.

‘We’ll see’!

I wonder how many of those people on Robinhood who claim they are the champions of the poor realize how their “sticking it to the rich /Hedge Funds” could potentially really end up damaging the accounts of those of us who are living in the middle ? What happens to those who year in and year out have dedicated a percentage of their “average” salaries to their 401k and/or IRA’s ? I happen to be one of those. I don’t have a fancy lifestyle by any means however no matter how small my wages I took the time to learn about investing and sought sound advice from others so that I would understand what was going on in my own portfolio. In fact I first ran across “Heisenberg” on seeking Alpha many years ago while simply trying to learn.

A friend of mine called me last night to tip me off that Dogecoin was being pumped. I jumped in and, I have to admit, it was pretty fun participating in the absurdity. It helped that I was able to walk away with 38% despite a brokerage app (Robinhood) that started to crash under the weight of the volume.

Then, today, I jumped on the AMC bandwagon for a spell.

This week is one for the history books. Absurd indeed.