If you’re expecting a correction for US equities or, at the least, for one of the most furious rallies in recorded history to calm down for a spell, you’re in good company.

Or at least if you like Morgan Stanley’s Mike Wilson, you are.

Wilson, who became something of a hero for the bearish crowd in 2018 when he pseudo-famously predicted a “rain storm” ahead of that year’s Q4 correction, generally called it right (on the bullish side) in the aftermath of the pandemic, in keeping with Morgan’s fairly assertive backing of the “V-shaped” recovery narrative.

Now, though, he thinks it’s entirely reasonable for recently buoyant cyclicals, and perhaps the market as a whole, to take what he described in his latest note as a “deserved vacation.”

Read more: Stocks, Reflation Trade Due For ‘Deserved’ Break: Morgan’s Wilson Suggests

I bring this up again, because in the course of discussing the cyclical trade and suggesting that, based on the post-financial crisis analog, stocks are on the verge of entering “a long consolidation period” characterized by “better earnings offset by multiple compression,” Wilson talked about liquidity and touched on many of this month’s hot topics in the process.

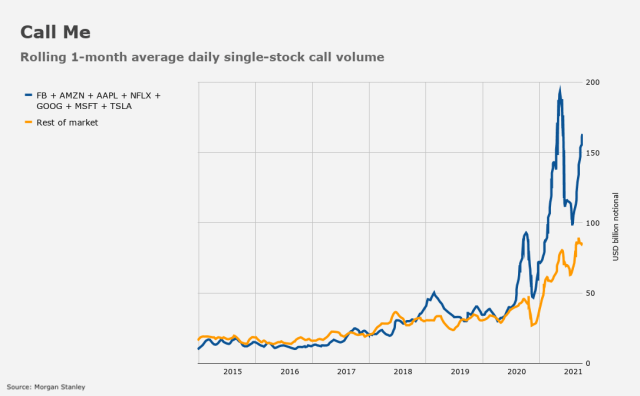

Even as monetary authorities in developed markets are likely to keep the spigots open, an aggressive expansion of already ample liquidity provision seems unlikely. But the Fed isn’t the only factor affecting liquidity, Wilson wrote, citing margin debt, call-buying, and “other forms of leverage,” which are all rising.

Obviously, that leverage finds its way into financial assets, as sure as night follows day.

Morgan Stanley went on to cite what the bank amusingly described as “widely available data and anecdotes,” in the course of suggesting that “it’s fair to say retail bullishness and activity has surged in the past few months.”

That’s likely a reference to incessant reporting on Reddit activity and other manifestations of retail investor behavior. This week’s obsession in that regard is GameStop, where shorts and Reddit gamblers are vying for supremacy in shares of the beleaguered retailer. Morgan’s Wilson noted that some of this behavior “has forced the institutional community to chase and/or cover shorts, which is just another source of increasing leverage.”

So, how do we know when the liquidity impulse really has peaked? That’s important, because if real rates start rising (or just stop falling) and/or earnings disappoint, stocks will lose some of the tailwind for the multiple expansion which has driven shares to the most expensive levels since the dot-com bust.

One suggestion is to simply look at Bitcoin, which had a rough go of it last week amid rumors of a glitch in the matrix.

Wilson reminded market participants that his “rolling bear market” call from 2018 began with the notion that Bitcoin might be among the first assets to suffer as the Fed continued to hike and attempted to normalize the balance sheet.

“Sure enough, [Bitcoin] topped first in mid-December 2017 and the rest is history, as every asset in the world eventually succumbed to the tightening financial conditions,” Wilson said Monday.

Indeed, 2018 was the year when cash ruled.

Clearly, the Fed won’t be tightening in 2021, so there’s little chance of a 2018 redux in that regard. But the point, for Morgan’s Wilson anyway, is that “if some big winners start to roll over, it could have a negative knock-on effect to liquidity as margin calls arrive and force additional selling.”

That’s where Bitcoin comes in. While the relationship between it and the S&P’s forward multiple is almost impossible to see on a quick glance, close inspection shows they do tend to peak and trough together.

Wilson drew a parallel with the euphoria following the Trump tax cuts and what may end up being a local peak in reflation optimism following the Georgia runoffs (figure below, from Morgan).

For Wilson, the takeaway is simple (and amusing): “If Bitcoin continues to fall, it would be just one more warning shot that P/Es may be peaking [while] if Bitcoin is able to make new highs, it likely means the speculative frenzy isn’t over.”

Whatever the case, Morgan is leaning towards to notion that “a correction/consolidation” in the S&P is likely to begin “imminently.”

As the farthest out the value chain or close to it, it would be hard to argue that if nothing else it cannot serve as a canary in this very strange coal mine.

re: Gamestop, hitting $240 after-hours, I’m actually getting a bit concerned that a bunch of youngsters (foolhardy or not) are getting egged on by sympathetic folks who ought to know better (Musk, Cramer, Palihapitiya) — and the kids are going to get burned as a result. Yeah, I know, it’s the price of the lesson. Still…

I’m guessing it’s just a few days before GME does a massive secondary, recap’ing with $billions and at the same time giving the shorts a chance to buy out at a “reasonable” $75-$100/share or so. I don’t think the denizens of wallstreetbets see it coming. If I were Melvin Capital, I’d have already started negotiating with GME a price for that secondary. A short squeeze doesn’t achieve squat for GME without it.

The Musks and Cramers et al. should be warning the kids, not encouraging them.

Tesla has done multiple secondaries. The immediate result of them was a stock price increase. Provided GME’s offering is of a limited size, the impact on its fundamentals may actually drive a share price increase. At the very least it does not have to be a negative event.

Not that I have skin in the game. Just noodling.

Wall of worry, or insanity. Still working on it.

Note that this is happening at the same time that one of the two major political parties in the US has essentially become a cult. Our pandemic response has been marked by superstition, misinformation, and the spread of unfounded rumors. I’m not sure what it will take to bring some sense of rationality to our realm, including markets, but it could take a lot.

I think there is a potential shock to the markets in the spread of the new coronavirus variants. B.1.1.7 (the UK variant) is already widespread in the US at a low level. CDC modeling predicts it will become the dominant variant in the US by March, though they so far are not predicting an out-of-control spike as has been seen with this variant in parts of the UK, Ireland, and Portugal. The UK has been on a full lockdown for a few weeks now, and that would not have been required had B.1.1.7 not emerged. The South African and Brazilian (Manaus) variants are of greater concern, and are starting to pop up in Europe and in the US (one case of the Brazilian strain in Minnesota today), though there is still the hope that the spread of these variants can be controlled in the US, at least until a substantial proportion of the population has been vaccinated. However, vaccine rollouts in the US is not likely to outrun the spread of the UK variant. The outcome will depend in a complex way on the willingness of Americans to maintain vigilance in the next few months, the pace and depth of vaccine rollout, and the coming of Spring. The Pfizer and Moderna vaccines seem to maintain efficacy against B.1.1.7. There is now some data that the Moderna vaccine retains efficacy against the South African strain, but that efficacy is reduced, on average, compared with efficacy against the original strains (such as the D614G variant that emerged early in Italy and is now widespread in the US). What this means in terms of real-world protection against the new strains is unclear. It now appears likely that the current wave of infections in Manaus, Brazil is due at least in part to reinfection by the new strain (P.1) of people who were already infected with the original strain in the original Spring 2020 wave.

I don’t know the specifics of the Game Stop mania, but any market analysis based on the idea that we are close to emerging into a post-COVID world has to be questioned. We might be, in the US, for a while–or we might not be.