It’s weeks like this when you wonder why we even bother with markets.

Sure, there’s a compelling narrative right now in bond land, where a pretty epic tug of war is playing out between fiscal stimulus expectations and the realities of an economy still grappling with a pandemic. Thursday was a perfect example. Jobless claims are approaching 1 million again, and Joe Biden is prepping a ~$2 trillion relief package.

And, yes, the same dueling forces are at work in equities, where reflation hopes are clearly prevailing, or at least if you go by the Russell 2000, which was up another 2% on Thursday, if you can believe it. That brings 2021’s YTD gain for small-caps to an astounding ~9%.

So far in 2021, small-caps are outperforming the Nasdaq by an even larger margin than that seen in November, when the Russell enjoyed one of its best rallies in history.

Why, then, do I say it feels like we shouldn’t bother with markets during weeks like this one? Clearly, there are topics worth discussing.

The problem, for me anyway, is that when something truly historic is unfolding (and the last days of Donald Trump’s presidency have been historic, albeit in a dubious way), everything else is irrelevant. How do you even begin to pretend as though it makes sense to talk at length about something besides what’s happening at the White House?

I don’t know the answer to that question. I know I’ve tried to mix up the coverage. And I know I’ve done a pretty good job, based on the fact that, unlike during previous episodes of political tumult associated with the outgoing administration, I haven’t received any irritable emails suggesting I harbor anything like “undue” bias. In fact, recent coverage has been lauded by private reader feedback, which means I’ve found an elusive balance. I credit that to my penchant for appealing to common sense when it comes to recent domestic political events.

In any case, all of that to say that I’m looking forward (almost with a childlike giddiness) to a day when it will no longer be necessary to document every twist and turn in an absurd Beltway soap opera and/or to lament the tragicomedy of America’s descent into farce. It’s testing the limits of my capacity to deliver satire in a world where satire is dead. I’ve succeeded, but I’d rather be breathlessly talking markets or writing exhaustively on socioeconomic issues. Soon enough, dear friends, things will calm down and allow for more of such worthwhile musings.

While small-caps, energy, and value all benefited Thursday from optimism around Biden’s economic plan, the broader market (and that’s actually a misnomer, because there’s nothing at all “broad” about an index that lives and dies by five tech names) drifted lower into the close.

Jerome Powell, speaking during a virtual forum from what looked like someone’s (maybe his own) living room, promised not to raise rates or taper bond-buying anytime soon. “Now is not the time to be talking about exit,” he said.

Powell, whose “plain English” approach to communicating with markets in 2018 got risk assets into all kinds of trouble, knows his way around a fireside chat these days, even if he still hasn’t quite attained the level of mastery necessary to put everybody to sleep during a post-FOMC press conference.

The “now is not the time” remark from Thursday was right out of the Kuroda script. If I had one share of a Japanese equity ETF for every time Kuroda said “it’s too early to discuss an exit,” I might own as many Japanese stocks as he does.

“I think that’s another lesson of the global financial crisis, is be careful not to exit too early,” Powell went on to say.

“We’ll let the world know,” he promised, referencing any possible tightening. “We’ll communicate very clearly to the public and we’ll do so, by the way, well in advance of active consideration of beginning a gradual taper of asset purchases.”

His remarks came on the heels of a silly back-and-forth between his colleagues, who inexplicably decided to talk up a possible taper in the second half of this year, only to reverse course.

Treasurys bear steepened Thursday, with the long-end cheaper by 5-6 bps. The past two sessions saw yields fall as 10- and 30-year auctions were well received. The focus Thursday was on Biden’s stimulus proposal. 10-year breakevens neared 2.09%.

“Powell contributed to the underlying steepening pressure via noting that ‘at the end of the day the public will need to see us allow inflation to move moderately above 2% for a time before the new framework will be seen as fully credible’,” BMO’s US rates team noted, adding that “this observation is consistent with the evolution of the policy framework and served to refocus the market on a few key knowns regarding monetary policy in the coming years.”

Basically, the Fed isn’t going to be hiking anytime soon. While it might make sense to bring forward expectations given new, more optimistic assumptions about the economy under a unified Democratic government, “bring forward” is a highly relative phrase. Maybe you can pull forward liftoff by a quarter or two, but it’s probably years out regardless.

As far as average inflation targeting, the idea of tapering bond-buying while inflation is still shy of 2% makes no sense — if you’re committed to overshooting the target to “make up” for past misses, you can’t very well tighten policy before you even get to the target.

“Those anticipating any less dovish policy stance at this stage in the pandemic/recovery are apt to be disappointed,” BMO went on to say.

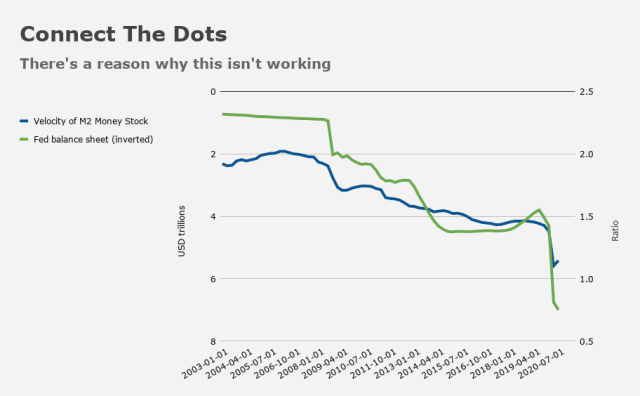

So, the Fed will keep buying bonds. And, although there’s the usual nuance when it comes to the actual breakdown of the funding mix, Treasury will keep issuing them. But remember: It’s not monetary financing, ok? Not as long as there’s a middleman, whose only purpose is to clog the policy transmission channel with the effect of driving velocity to zero.

Finally, just in case you were unclear about Powell’s position, he also said the following about the timing on any first rate hike: “No time soon.”

I don’t know exactly what that means, and neither does Powell, but rest assured there are some STIR traders out there who think they do. And, because it’s ultimately the bond market that determines when the Fed cuts and hikes anyway, maybe these virtual events should feature traders instead of Powell.

Thanks for your tireless efforts to cover this ridiculous chapter- frankly, I am just ready to move on.

Agreed.

But the real value of Mr. (not Dr ??) Heisenberg’s commentaries for me has been to open my eyes to the outsized influence of “Risk Parity” and other volatility-driven models.

For ten years it turned out that share buy-back numbers were the major if not only factor driving stocks prices. Simple supply & demand which drives any market, be it QQQs or Smoked Rubber Futures in KL, (both of which I have been privileged enough to trade in during my useless but happy enough career.) Luckily enough , I picked up on that and begrudgingly came to realize that valuations do not matter.

More recently, I owe H-berg a huge debt of gratitude for opening my eyes to the overwhelming influence of these flows.

Thanks for all of your amazingly tireless work.

The next step will be lengthening the duration of the balance sheet, to make room for more issuance by US Treasury in the long end.

Really like the new fonts and formatting. Easy on the eyes.