“It made an illegible, long-running process legible instantaneously by the force of an unprecedented act,” Deutsche Bank’s Aleksandar Kocic wrote Friday evening, describing the events that unfolded in the US on January 6.

It’s still difficult to find the correct set of adjectives. To my mind, it’s as yet unclear whether what transpired on Capitol Hill this week counts as an event that, as Chuck Schumer suggested, ranks with Pearl Harbor among “days that will live in infamy” or whether it was just the inevitable culmination of a four-year, tragicomedic Broadway run — a day when a fraction of American capitalism’s undereducated, aggrieved left-behinds, accidentally learned an absurdist lesson when, upon breaching the seat of the country’s democracy, found that lawmakers had fled, while the leader of the “insurrection” retreated to the White House to ponder the spectacle from a safe distance.

Take “Elizabeth from Knoxville,” a late thirty- / early fortysomething who went viral Wednesday after she sobbed to Yahoo News about getting pepper sprayed by police after making it “like a foot inside” the Capitol. Asked why she was breaking into a US government building in the first place, an exasperated Elizabeth seemed to suddenly realize the inherently ridiculous nature of her endeavor: “We’re storming the Capitol,” she said, her voice quivering. “It’s a revolution!”

(Frank: “We’re… We’re going streaking! We’re going up the quad and to the gymnasium.”)

There was all manner of speculation about whether “Elizabeth from Knoxville” was acting, but that isn’t the point. The point, rather, is that Wednesday’s events in D.C., as “shocking” as they were, were unmistakably and undeniably farcical. (Obviously, that is in no way meant to trivialize the senseless loss of life — indeed, the futile nature of the “revolution” makes that loss all the more tragic.)

In his Friday note, Kocic wrote that “from the point of view of their social and political significance, the scenes we witnessed on Wednesday count among the most unsettling in modern American history, with a strong possibility of leaving profound long-term consequences.”

There can be little doubt about that. America will now proceed knowing that “it can happen here,” where “it” refers to autocratic rule.

But, markets weren’t bothered. The events’ “impact on the market has had the opposite effect,” Deutsche’s Kocic remarked. “What took place on that day transcended all expectations,” he continued, referring not just to the Capitol melee, but also to the Georgia runoffs.

And yet, “despite an outsized move in rates, the markets relaxed and short-dated volatility collapsed,” he added, noting that “this was yet another reminder that we don’t live in a society, but in an economy.”

Beyond that, though, Kocic offered a characteristically incisive take which, while touching on a familiar theme (namely, increased odds of a larger and more persistent fiscal impulse which, in turn, has implications for the Fed), is more poignant given the adeptness of the author’s digital pen.

“This reaction of volatility has another side that explains it in a simple way,” Kocic said, adding that,

As disruptive as they might seem, last week’s events made it easy to put things in perspective. They framed the effects of political entropy unambiguously and cleared the terrain for consensus building (social, economic, and political). In terms of their economic implications, their most important consequence is a possibility of reaching an agreement about a more flexible fiscal stimulus. This, in turn, implies a higher likelihood of having a less heavy-handed monetary policy.

Thanks to the results of the Georgia runoffs, the odds of total gridlock or, worse, fiscal retrenchment in the face of ongoing economic malaise, have been materially reduced.

A Democratic Senate ensures that, at the least, fiscal-monetary coordination aimed at improving socioeconomic outcomes can make some headway, albeit not the kinds of strides Progressives would like to see.

This policy conjuncture explicitly aims to promote a more inclusive economy. An economy that addresses the concerns of so many “Elizabeths from Knoxville,” not by blaming the country’s bilateral trade deficit with China, not by blaming the immigration system, and not by making fantastical claims about the overnight resurrection of industries like coal mining. Rather, by having a serious discussion about what kinds of policies are needed to address complex problems.

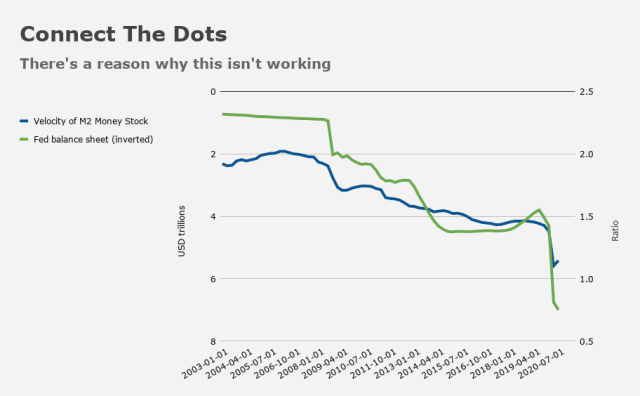

Readers will justifiably fret that in the absence of overt government debt monetization, the current mechanism through which QE operates will continue to impair the monetary policy transmission channel (figure below), while serving to inflate financial assets further.

More simply: As long as the Fed, Treasury, and Congress refuse to countenance actual “helicopter money” (whether in the form of UBI, across-the-board student debt forgiveness, a federal jobs guarantee, or an earnest infrastructure push), arm’s length deficit financing and the suppression of savings rates will simply exacerbate inequality, leading to even more societal division.

Nevertheless, it’s safe to say that another four years of political entropy and the likelihood of austerity under a Republican Senate would have doomed demand-side stimulus, choked off fiscal initiatives, and thereby forced the Fed to remain in easing mode in perpetuity.

At the least, that outcome was avoided.

If Senate Republicans continue to enable Trump in the days before Biden’s inauguration, I think you’ll see Sen. Murkowski and at least one other Republican senatar (Collins, Sasse, or Romney) deciding to caucus with the Dems. The Republicans re-elected Ronna McDaniel as their party head on Friday; under her leadership over the last four years, the Republicans lost the House, the Senate, and the White. If Republicans think continued support for Trump and Trumpism is the path out of the wilderness, I’d like to introduce them to an old Whig I know.

White House

Hmm. If a significant portion of Latinos/Hispanics switch to GOP (and GOP is smart enough to declare them the newest “whites” – after the Irish and the Italians) then they may actually continue for a lot longer.

Basically, lots of people are naturally conservative. Indeed, the vast majority of us tends to be in most aspects of our lives. Being a progressive is hard work.

So Trumpism isn’t necessarily dead. Right wing populism is a very popular policy position and can be extremely successful. TBH, I was always surprised at how well the GOP was doing with so many broadly unpopular economic positions.

I hope you’re right, but I think its wishful thinking. I’ve been waiting for years for people to see the light, it keeps not happening

Maybe it is like predicting a bubble. You know it is coming and it is going to pop but can’t say when and it seems to always take longer than you expect. Maybe this is just wishful thinking.

this is the only way I can think of that could change the current dynamics. If sufficient fiscal support for those impacted by the COVID economy, is provided and inflation picks up, there is no scope for the Fed to keep pushing QE. SO the markets will have to align to the new reality.

Q4 2018 comes to mind… Sure, this time around, an economy invigorated by middle class spending might soften the blow but multiples may come down after all.