Normally, I would have almost no interest whatsoever in what Warren Buffett did or didn’t do during a given quarter, let alone what Omaha’s favorite octogenarian did or didn’t say once the quarter was over.

And, to be completely honest, my level of interest following Q1 2020 isn’t materially greater than zero, either. It’s probably not accurate to call Buffett disingenuous, but it’s irksome that so many retail investors swear by his bottomless store of amorphous aphorisms which, in most cases, could just as easily apply to walking across the street as they could to investing. It’s entirely fair to suggest that the majority of his acolytes have no conception of the extent to which Buffett’s entire career has been spent operating what amounts to a massive activist hedge fund financed (both figuratively and literally) by a giant short put position.

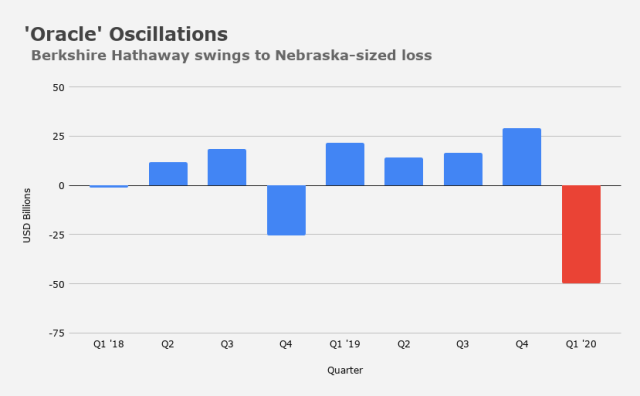

Despite my lack of interest, I’d be remiss not to note that Berkshire Hathaway swung to a massive loss in Q1, and by “massive” I mean almost $50 billion. Quarterly operating income – which Buffett always prefers you focus on, but especially during times like these – rose nearly 6%.

You can thank a $54.5 billion on-paper loss in Buffett’s stock portfolio for what you see in that chart.

Even an “oracle” can’t make projections about the future in a pandemic, and prognosticating is made immeasurably more difficult when you’ve got your hands in pretty much every kind of business known to mankind. Hence the following totally nebulous assessment from the 10Q:

The novel coronavirus (“COVID-19”) spread rapidly across the world in the first quarter of 2020 and was declared a pandemic by the World Health Organization. The government and private sector responses to contain its spread began to significantly affect our operating businesses in March and will likely adversely affect nearly all of our operations in the second quarter, although such effects may vary significantly. The duration and extent of the effects over longer terms cannot be reasonably estimated at this time. The risks and uncertainties resulting from the pandemic that may affect our future earnings, cash flows and financial condition include the nature and duration of the curtailment or closure of our various facilities and the long-term effect on the demand for our products and services. Accordingly, significant estimates used in the preparation of our financial statements including those associated with evaluations of certain long-lived assets, goodwill and other intangible assets for impairment, expected credit losses on amounts owed to us and the estimations of certain losses assumed under insurance and reinsurance contracts may be subject to significant adjustments in future periods.

Again, that is laughably indeterminate, even by the standards of the always indeterminate language associated with regulatory filings. Buffett should have slipped in a joke: “What am I, some kind of ‘oracle’?”

As Berkshire reminds you, the company engages “in a number of diverse business activities” and manages “operating businesses on an unusually decentralized basis”. By that, Berkshire means “there are essentially no centralized or integrated business functions and there is minimal involvement by our corporate headquarters in the day-to-day business activities of the operating businesses”.

Given that, there is zero chance that Berkshire is going to be able to predict, with anything even approaching confidence, how operating results are likely to look as the pandemic evolves. Here’s what the filing had to say about the events that unfolded over the past two months:

As efforts to contain the spread of the COVID-19 pandemic accelerated in the second half of March and continued through April, most of our businesses were negatively affected, with the effects to date ranging from relatively minor to severe. Several of our businesses deemed essential have continued to operate, including our railroad, utilities and energy, insurance and certain of our manufacturing, distribution and service businesses. However, revenues of these businesses have slowed considerably in April. Other businesses, including several of our retailing businesses and certain manufacturing and service businesses are being severely impacted due to closures of facilities where crowds can gather, such as retail stores, restaurants, and entertainment venues… While we believe [actions taken] are temporary, we cannot reliably predict when business activities at our numerous and diverse operations will normalize. We also cannot predict how these events will alter the future consumption patterns of consumers and businesses we serve.

There you go. The “oracle” can’t predict anything about anything.

That indeterminacy showed up in Berkshire’s cash hoard, which ballooned to a record $137 billion during the quarter, despite what you’d think would be buying opportunities for a man such as Buffett, who’s known for stepping in (some might even call it “intervening”) during crises.

Those looking to Buffett for the green light to buy equities will be sorely disappointed. Berkshire bought just $1.8 billion in shares during Q1 and dumped more than three times that amount in April alone (on net).

“During the month of April we received approximately $6.1 billion from the sales of equity securities, net of the costs of equity securities purchased”, the filing says, noting that the proceeds were plowed into bills (i.e., cash).

Despite a near 20% decline in Berkshire’s share price in Q1, Buffett repurchased less of the conglomerate’s stock than he did in Q4.

All told, cash holdings rose $9.3 billion during the period, nearly triple the combined total of stock purchases plus buybacks.

Coming full circle to where we began, Buffett’s index puts resulted in a pre-tax loss of $1.393 billion in Q1.

This is one time when shaking the magic 8 ball came back with “Reply hazy, try again later”.

” extent to which Buffett’s entire career has been spent operating what amounts to a massive activist hedge fund financed (both figuratively and literally) by a giant short put position.”

H, your humor has no bounds.

Carry on!

Well….I am thinking about an investment in insurance companies.

Buffett jokes are the best jokes. Just don’t make them in the company of retail.

H-Man, since he sold all of the airline positions, probably started writing puts on those same airlines in order to buy back into those airlines on the cheap. Same playbook as in the past or use the BA investment page, I loan you money convertible into equity. Less risk on this trade vs the put option trade. Also by selling the airline stock, the lawsuit risk drops which is substantial if he played that game while being an equity holder.

Investing on Main St works well until Main St is shut down. Slum landlords know all about this. The only places making money are payday loans and pawn shops.

The Oracle shows no confidence, US-China tensions revived, retail stores about to report earnings, non-farm this Friday, a nice confluence of events with little upside but a lot of juicy downside for US markets near term. Looks like our friend negative gamma will return sooner than some expected