Just as acute stress in dollar-funding markets spilled over into the spot market pushing the greenback “vertical” earlier this month, an easing of that stress thanks to the Fed’s extension of swap lines has helped facilitate the dollar’s worst week since 2009.

I mentioned this in a predawn note Friday, but it’s worth reiterating given how incredibly important this dynamic is for all assets and, really, for the entire global financial market “plumbing”, if you will.

“The Fed grew its swap lines with other central banks by USD206 billion in the week to Wednesday, and they’ve increased a little more since then”, SocGen’s Kit Juckes wrote Friday, observing that “this was a bigger weekly change than at any point in the financial crisis, although the total increase in the swap lines at the height of the GFC was almost USD600 billion”.

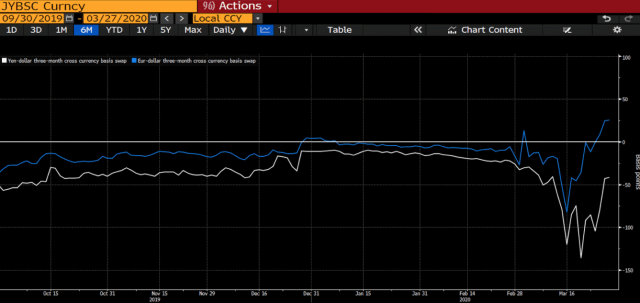

The abatement of pressure is evident in cross-currency basis.

“[The] dollar is heading to [its] worst week since 2009 on the incredible liquidity easing via central bank provisions [and] EURUSD and GBPUSD xccy basis are now POSITIVE”, Nomura’s Charlie McElligott notes. The all-caps is in the original, and the emphasis is to contrast the current state of affairs with the scary widening seen last week, when the Fed was playing a nightmarish game of “Whac-a-Mole” in a frantic scramble to put out myriad fires.

(BBG)

There’s still some stress in Japan, though, where demand for USDs has manifested in huge participation in dollar-swap auctions.

“That said, the USDJPY xccy remains meaningfully negative, and yen-basis is still the ‘benchmark’ for perception of $funding stress in these markets”, McElligott went on to remark, noting that this likely “reflects Japanese ALM rebalancing demand into foreign assets, but most certainly corresponds with [the] Japanese fiscal year-end funding grab”.

Consider how this is all playing out in Japan.

“The introduction of cheaper, more regular dollar-swap auctions has generated huge demand from US currency-starved dealers who are keeping their JGBs to put them down as collateral”, Bloomberg’s Stephen Spratt wrote, in an amusing piece out earlier this week. That means the incentive to sell to the BOJ is commensurately diminished. And, so, you get this:

As Spratt goes on to write, “the surge in demand [for JGBs as collateral] comes just as the BOJ steps up JGB purchases to provide liquidity to financial markets grappling with the worsening coronavirus outbreak”. But if folks have better things they could be doing with their JGBs, they’re not going to be inclined to sell.

It’s comical, in a sense. This is basically one rescue mechanism tripping over another, and it forced Kuroda to step up repo operations and roll out even more measures aimed at keeping things from going haywire. (Data from JSDA shows things normalized on Wednesday, Thursday and Friday, but not so much for longer tenors).

In any event, it’s all calming down, if only temporarily. The dollar oscillated during the US session on Friday, but was still headed for its worst week in more than a decade. “It’s 100% a dollar-funding story”, one strategist told Bloomberg. “Mean reversion of the USD liquidity crunch is prompting all other FX to rally against the dollar”.

One is reminded of something SocGen’s Juckes said in December, long before anyone was worried about a pandemic: “The world’s a nicer place when the dollar’s on the back foot”.

Virus war triggers stealth currency war? The GFC did spark that dynamic and there was bitching about that stuff. The only thing this virus understands is money, thus, cash is King!