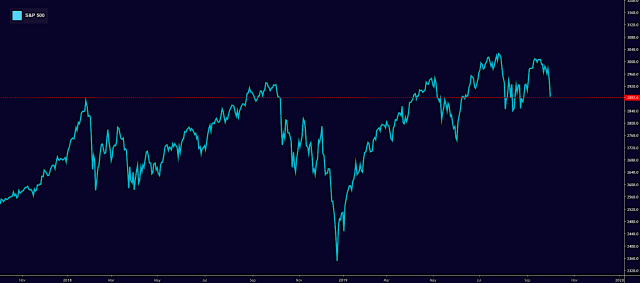

US equities went into an uncontrolled dive to start the fourth quarter, with the S&P losing some 3% over two sessions.

But don’t worry, Donald Trump knows just what the problem is: Democrats.

“All of this impeachment nonsense, which is going nowhere, is driving the Stock Market, and your 401K’s, down”, Trump said Wednesday, as stocks careened lower on what, in reality, were growth concerns likely exacerbated by systematic flows.

With stocks squarely on the back foot as market participants ponder the prospect of a sudden downturn in the previously resilient US economy, all eyes will turn to ISM non-manufacturing and September payrolls.

If data due Thursday shows the services sector rolling over, the bottom could fall out entirely unless Trump somehow manages to rescue sentiment with a trade tweet or some other stick save. It’s worth noting that for all the president’s bluster about the market, stocks have actually gone nowhere for going on two years.

Generally speaking, he’s found a scapegoat for each and every selloff, with Jerome Powell being the most frequent punching bag. But in reality, all of the readily observable market swoons since January 2018’s post-tax-cut, blow-off top, were attributable, at least in part, to Trump’s words or actions (with the exception of the VIX ETN extinction event in February 2018).

Risky assets were already on shaky footing heading into October thanks to “mixed economic data and further political uncertainty, including the impeachment inquiry in the US and the Trump administration reportedly considering restrictions on US investors’ portfolio flows into China”, Goldman wrote earlier this week, in a kind of pseudo-warning.

“Looking at different sentiment indicators, investors have likely increased their exposure to risk from the light level of August and positioning looked more neutral overall” going into Q4, the bank said, observing that fund flows into risky assets “outpaced those in safe assets for two consecutive weeks in September and government bond weekly flows turned negative for the first time since February”. However, that changed last week in what now looks like a bad omen.

(Goldman, as of September 30)

“Better news on the macro front is likely needed for a pro-cylical rotation to last”, Goldman went on to write.

Suffice to say this week has not produced “better news on the macro front” – or on the geopolitical front for that matter. Now, it’s gut check time.

With the manufacturing slump firmly entrenched abroad and starting to bite in the US, and with global growth prospects dimming with each successive trade escalation (on Wednesday, the Trump administration announced new tariffs on the EU after securing a win in the long-running Airbus subsidies dispute), the fate of the universe seemingly hangs on the services sector, the US labor market and the American consumer.

Sentiment is faltering and the trend in job growth is too. Retail sales are still holding up, even as the August read on personal consumption was the weakest in six months. The whole thing has a “hanging by a thread” feel to it.

As far as whether it’s possible that more dour data might eventually usher back in the “bad news is good news” dynamic for risk assets, whereby as long as the data doesn’t portend an outright calamity, stocks benefit from expectations of monetary policy easing with an added mechanical boost attributable to falling bond yields, SocGen’s Andrew Lapthorne likened that to a “game of chicken”, in a note dated Tuesday. To wit:

We have long warned about the danger of an equity market propelled higher by lower bond yields, itself a harbinger of greater economic uncertainty. Many argue that low bond yields justify higher stock valuations, but in a bear market ALL stocks tend to lose money irrespective of their relative cyclicality. So investors are playing a game of chicken: hoping lower bond yields do not lead to a recession, but equally that the global economy remains sufficiently moribund to not cause bond yields to rise and negatively impact expensive defensive and growth stock valuations.

That’s a perilous game to play, although it certainly worked out well during the first half of 2019, as stocks surged and bond yields plunged, contributing to the vaunted “everything rally”.

And yet, in aggregate, investors remain risk averse.

“Flows into safer assets have been strong year-to-date, especially in money markets, while net equity inflows remain negative, signaling that positioning still largely reflects an investor risk-off bias”, Goldman reminds you.

As for what comes next, the bank writes that after flirting with zero, their Risk Appetite Indicator “is now turning more negative, in line with our view that it will struggle to break into positive levels without stronger macro outlook and growth prospects”.

(Goldman)

Getting back to Donald Trump, he really – really – needs you to understand that this has nothing to do with the trade war or the global manufacturing slump or a US economy that’s experiencing the early stages of withdrawal now that the sugar high from fiscal stimulus is fading.

Rather, it’s all a conspiracy. To quote the president, this is “exactly what the Democrats want to do”.

If you’re buying that, we’ve got a Trump Steak, a degree from Trump U. and some WeWork bonds we’d like to sell you in a package deal.

We’ll even throw in some Javelin anti-tank missiles – but only if you “do us a favor, though“.