Indian equities exploded higher and bonds plunged on Friday after Finance Minister Nirmala Sitharaman said the country will slash taxes for local companies in a somewhat dramatic bid to boost growth.

The base rate for domestic companies was cut to 22% from 30%. The effective rate will be 25.2% after accounting for additional levies.

Local equities, which just entered a correction after suffering massive foreign outflows in Q3, staged their biggest rally in a decade.

India has now brought its tax rate in line with other Asian nations, a decision that could help one of the world’s most important emerging markets lure enterprises seeking a haven for manufacturing operations amid the seemingly intractable Sino-US trade conflict.

The rate for new companies started after the beginning of next month will be just 15% (effective rate of 17.01%), on par with Singapore.

“Reducing the corporate tax rate to 25% is big bang reform”, Kotak Mahindra Bank CEO Uday Kotak said. “[It] allows Indian companies to compete with lower tax jurisdictions like the US [and] signals that our government is committed to economic growth and supports legitimate tax abiding companies”, he added, calling Friday’s move “a progressive step forward”.

The move will entail a step backwards for the budget, though. Specifically, it will mean a loss of more than $20 billion in revenue, something Sitharaman is aware of. “We are conscious of the impact all this will have on our fiscal deficit”, she said.

The bond market is “conscious” of it too. 10-year yields surged 15bps.

“The announcement of new tax rates will have a material impact on India’s fiscal numbers in the near term”, Barclays said Friday, adding that “the cumulative impact of today’s announcements on revenues will be around INR1.45trn (70bp of GDP) and barring any alternate source of revenue or expenditure rationalization, the fiscal deficit is likely to rise materially”.

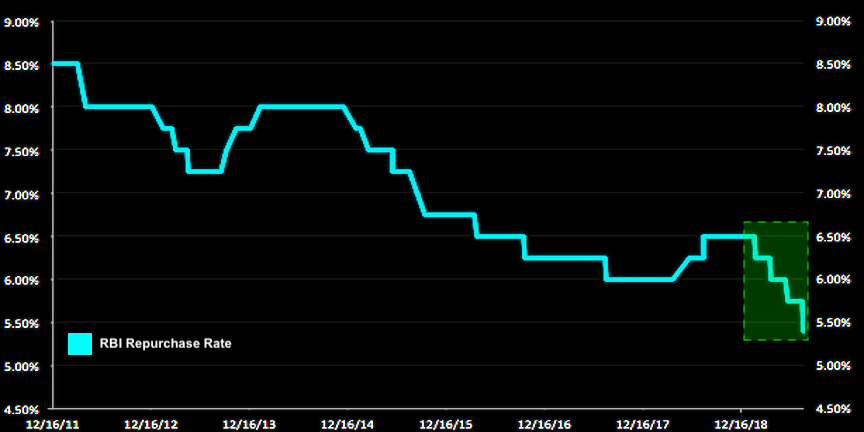

This comes on the heels of a series of RBI cuts, amounting to 110 bps in easing this year alone under Shaktikanta Das, who replaced Urjit Patel after the latter’s abrupt resignation late last year.

The RBI cut rates an “unconventional” 35bps in August. It was the fourth cut of 2019.

Speaking at the Bloomberg India Economic Forum in Mumbai on Thursday, Das tipped more policy easing ahead. On Friday, he called the tax cuts a “bold move”.

So, worries about fiscal “slippage” notwithstanding, India is pairing fiscal and monetary stimulus in the service of reviving growth, a one-two combo that many believe will serve as a template going forward with monetary policy in developed economies bumping up against the limits in terms of shouldering the burden of engineering and maintaining growth.

The Indian economy expanded by just 5% in the three months ended June, marking the most sluggish pace since March of 2013.

“We estimate that the total impact on growth from the tax cuts may be as much as 0.5-1.0pp in nominal terms, taking into account improved compliance, removal of deadweight loss in terms of taxation, and reduced spending on tax compliance”, Barclays projects. “This may end up being as high as 0.3-0.8pp in real terms, depending on the cascading impact on investment and consumption [but] for now, we do not change our GDP projections from 6.0% and 7.0% in FY20 and FY21 respectively [and] continue to expect 40bps of rate cuts in the October policy meeting by the RBI”, the bank went on to say.

All of this comes ahead of Narendra Modi’s trip to the US later this month. New Delhi has been working furiously to cobble together some kind of package of possible concessions to present to Trump as a stepping stone towards an easing of trade tensions between the two countries after the US yanked India’s GSP status earlier this year.