Early Monday, we brought you some highlights from the latest edition of the National Association for Business Economics’ semiannual survey, which showed three-fourths of panelists expect a recession by the end of 2021.

That, we noted, was generally consistent with some of the more cautious takes from Wall Street, where, despite strategists’ penchant for steering clear of recession calls, economists are having a harder and harder time justifying the contention that the expansion still has legs.

Read more

Treasonous Business Economists See US Recession On The Horizon

The same survey showed business economists generally don’t agree with the market when it comes to whether the Fed is in fact done hiking rates for the cycle. Specifically, a majority of NABE panelists still expect one or two hikes in 2019.

To be sure, some on the Street are similarly unconvinced that the Fed is really finished, but there’s no denying that the dovish pivot inherent in YTD Fedspeak and enshrined in policy via the January statements and presser, puts the onus squarely on the data when it comes to justifying a return to rate hikes.

Meanwhile, the Trump administration is still feeling pretty good about the prospects for growth – or at least that’s the party line. At this point, it’s impossible to separate what the likes of Kevin Hassett and Larry Kudlow really think from what the propaganda machine demands they say in public.

Frankly, if either of those two stooges were to even suggest, in front of a camera, that Trump’s MAGA “miracle” might come up short when it comes to producing annual GDP growth of 3% (or 4%, depending on which Trump speech/tweet you want to go by), they’d probably be fired. No, seriously – they’d probably be fired.

Well, in the interest of giving everyone an update on the “lay of the land”, so to speak, we thought it was worth briefly highlighting a couple of charts from the latest edition of Goldman’s “Where To Invest Now” slide deck.

When it comes to annual US GDP growth, consensus expects a 2.5% rate of expansion in 2019, well short of what would satisfy Trump. For their part, Goldman sees just 2.2% growth this year and a marked deceleration thereafter (left pane below).

(Goldman)

As far as recession odds go, Goldman puts the probability of a downturn in the US within the next three years at 43% and the odds of a recession within the next 12 months at 10%.

(Goldman)

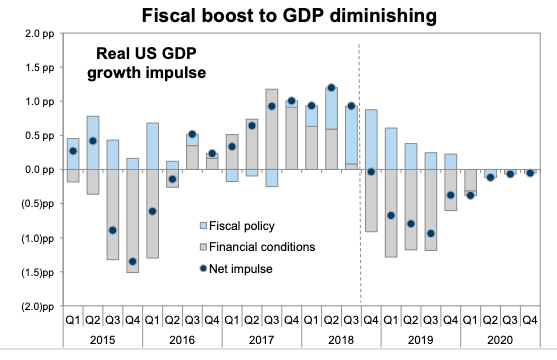

One thing worth keeping in mind is the extent to which the fiscal tailwind is not only set to fade rapidly, but will in fact turn into a headwind by Q1 2020.

(Goldman)

As you’re probably aware, both the soft and hard data have decelerated (on balance) of late, with the exception of the labor market. Here’s a quick breakdown across indicators:

(Goldman)

Finally – and I think we’ve mentioned this before – if history is any guide and the Fed is in fact done hiking, then stocks “should” rally at least for another 12 or so months (2000 being an exception to this “rule”).

(Goldman)

Again, there’s nothing particularly profound in any of that, but with all of the recession talk floating around out there, the visuals shown above serve as handy pocket guide for those wanting a quick read on where things are and where consensus (and Goldman) thinks things are heading.

Of course really, the only forecast you need is that which emanates from Larry Kudlow’s mouth, because after all, Larry is a man who knows how to call ’em…

There is no recession. Despite all the doom and gloom from the economic pessimistas, the resilient U.S economy continues moving ahead quarter after quarter, year after year defying dire forecasts and delivering positive growth. These guys are going to wind up with egg on their faces.

– Larry Kudlow, in the National Review on December 7, 2007

these guys are going all the way out to end of 2021 to call a recession. What are your own estimates telling you heisenberg?

you won’t need a recession for things to feel ugly. nominal GDP growth lower than 4% trending towards 3% will all that is needed to start feeling the pinch. at 3% nominal, in a highly leveraged economy, debt will feel onerous, credit spreads will widen and lending will rapidly slow- and the economy will be highly vulnerable to a shock. many of the pundits are overly optimistic about first quarter growth and inflation is already heading to 1.5%.