Well, there was more bad news for Deutsche Bank on Friday, because you know, why not, right?

Apparently, HNA is going to get rid of its stake in the lender and not even because it necessarily wants to, but rather because it has to. China is reportedly putting pressure on the conglomerate to pare down overseas investments and refocus domestically, closing the book on an aggressive global acquisitions binge.

According to Bloomberg, the stake is now mostly in derivatives, which might mean offloading it won’t materially impact Deutsche’s shares. Nevertheless, they’re down pretty sharply on Friday.

Unfortunately for the downtrodden Stoxx 600 Banks index, this came on the same day as news about an internal ING memo that reportedly suggests its license to operate may be at risk. ING says the newspaper report (which appeared in Dutch financial daily Het Financieele Dagblad) is riddled with inaccuracies. ING also insists that it has no problem meeting regulatory requirements.

Ultimately, the SX7P is now sitting at a 22-month low and is mired in a bear market. All of the above only adds to the negative news flow in a space that last month struggled with reports that the ECB is concerned about the exposure of UniCredit, BNP, and BBVA to Turkey.

With that, we’ll leave you with the latest from our friend Kevin Muir of “The Macro Tourist” fame, reposted here with permission.

When talking to credit managers, I always ask for names that they are avoiding. More times than not, one of the companies mentioned is Deutsche Bank. Credit managers either feel it is too complex to value, or they do not trust the markings of the smorgasboard of derivatives that decades of unrestrained capital market share growth has brought.

After all, we are talking about the firm audacious enough to buy Bankers Trust. I am old enough to remember when Bankers was the firm when it came to complex derivative products.

Yet with this superstar status came a very aggressive trading culture.

Who can forget forget BT pillaging P&G in the infamous ‘wet dream’ trade?

Do you really think this ‘ROF’ (rip-off factor) wouldn’t also be aimed against the firm as well?

Back then traders were paid up front for derivative trades that would sometimes be on the book for years and even decades to come. Deutsche Bank was more willing than many other Wall Street firms to allow these sorts of trades to garner market share – but I sure wouldn’t want to be the one managing that risk for the life of the product.

And I shouldn’t blame it all on BT. Deutsche Bank got into a fair amount of trouble on their own during the 2008 credit crisis. Although Ryan Gosling was smart enough to get short the housing sector, there were plenty of other Deutsche Bank employees that were long out the hoop.

All in all, Deutsche Bank has typically been an overleveraged, difficult to value, aggressive global bank that seems to only participate in the negative portions of each region’s fate.

So it is with little surprise that the current European economic struggle is affecting DB more than the other global banks.

Let’s look at the US “DB-equivalent” Citibank over the past five years:

Citibank has managed to eke out almost an 8.50% annualized return while Deutche Bank was negative 18% with a total loss of 66%.

And it’s not like Citibank hasn’t had its share of problems. For the longest time, the bond market viewed Citi as a bigger risk than Deutsche Bank.

That changed over the past few years as the market has grown more comfortable with Citi’s credit while that of Deutsche Bank has become a bigger perceived risk. In 2016 DB’s CDS hit a level that was higher than the 2011 European credit crisis. And so far this year, even as stock market indices hit new highs, DB’s 5-year CDS has exploded from 50 bps to 140 bps.

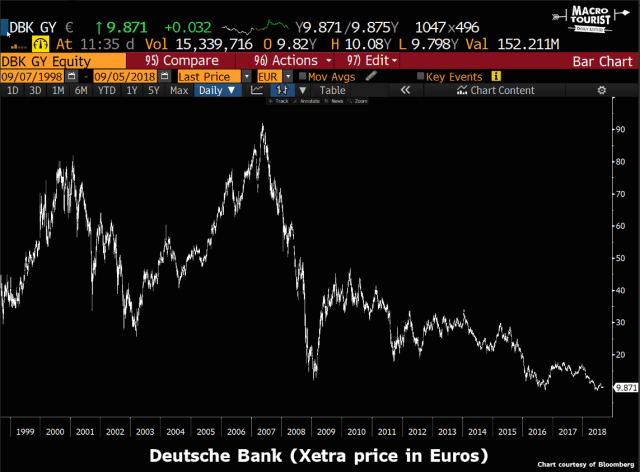

The market hates Deutsche Bank. No wonder all the credit managers are bearish. The charts look like death.

But when everyone hates something, it sometimes brings opportunity.

This point was driven home the other day when I listened to Barry Ritholz’s Masters in Business podcast interview with Research Affiliates Robert Arnott. According to Rob, from 1989 to 2017, stocks added to the S&P 500 index underperformed the stocks removed from the index by an average of 23% over the ensuing twelve months.

Stop and think about that for a second. By the time a stock gets booted out the index, it’s probably too late to sell. I know it feels terrible and it often is at the absolute darkest moment, but that’s what makes it such a great time to buy.

So it was with great interest I noticed the following headline from Bloomberg a couple of days ago:

For the first time since the introduction of the Euro Stoxx 50 index in 1998, the venerable Deutsche Bank is being removed.

Then this morning, I noticed another headline (this time in the FT):

Another large German bank being uncermeniously dumped from an index – this time instead of the Euro Stoxx 50, it’s the German DAX benchmark. To add insult to injury, Commerzbank is being replaced by a FinTech startup!

Whereas most investors will probably read these headlines and get all beared up, I look at these developments as extremely bullish omens.

German banks are unloved. Of course they are difficult to value and a complete gong-show, but Deutsche Bank is basically synonymous with Germany. Their government will not let it fail.

And sure, it might go lower, but I take solace in Rob Arnott’s stats. It’s never easy to buy deep-value stocks (and I might be stretching it by putting Deutsche Bank into this category), but my gut tells me the next 50% move in DB is higher, not lower.