It’s no secret that the “broad” market isn’t very broad.

History is replete with examples of extreme market concentration, so there’s a sense in which the FAAMG contingent’s dominance of the S&P 500 isn’t entirely anomalous.

Still, it’s difficult to escape the feeling on some days that “US equities” is just a polite euphemism for “FAAMG.” That’s even more true when you endeavor to discover “where the growth is,” so to speak.

Coming into earnings season, big-tech traded at an extremely elevated multiple (figure below).

Looking back on reports from the heavyweights, it’s probably fair to call earnings for the group “mixed,” but a little payback (e.g., for Apple and Amazon) in the form of lost sales and higher expenditures to cope with supply chain disruptions, is a small price to pay considering the extent to which the pandemic reinforced consumers’ inextricable link with technology and underscored the contention that monopoly allegations notwithstanding, America’s tech behemoths are in many ways indispensable.

As it turns out, they’re also responsible for a disproportionate share of corporate cash spending. In fact, between them, FB, AMZN, AAPL, MSFT, and GOOGL account for almost a fifth of S&P 500 cash spend.

As Goldman observed, in a new note, those five stocks have, over the last half-decade, “grown the various uses of cash by 22%,” compared to 0% for the S&P 500 (figures below, from Goldman).

Between them, the companies have almost a half-trillion dollars in cash on their balance sheets. There’s “no sign” they intend to stop using it, Goldman wrote, flagging buyback programs from Apple, Google, Facebook and Microsoft, as well as Apple’s commitment to invest hundreds of billions in the US.

This is yet another example of how the same handful of companies play Atlas to the market, and speaks to the risk associated with deliberately interfering with their capacity to… well, to keep doing all the things they’re doing.

That’s certainly not an argument for letting monopolistic practices go unanswered and unchecked. It’s just a friendly reminder that knee-capping the companies will have consequences, some intended, others not.

Writing last week, BofA’s Michael Hartnett said there are three things capable of killing a tech bull market. The fist is saturation on the product side. That doesn’t seem to be a problem, or at least not one that’s likely to emerge as a serious headwind anytime soon. Demand will ebb and flow depending on the product, but the world’s appetite for gadgets and the apps that run on them is insatiable as far as we know.

The second tech killer is regulation. Hartnett cited China as a particularly poignant example. Although the regulatory push isn’t likely to abate in the US, especially considering regulation of big-tech is among the only issues that enjoys real bipartisan support on the Hill, it’ll move at a snail’s pace.

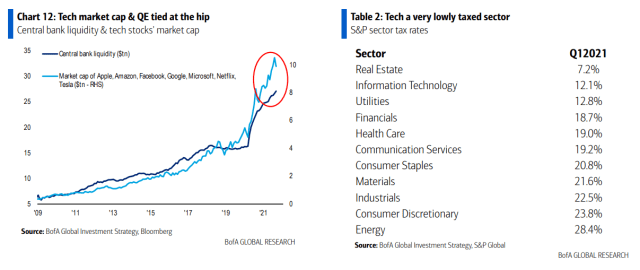

Finally, there’s rates. And on that front, the jury is still out. “Tech market cap and QE are tied at the hip,” Hartnett said, adding that “once the Fed aggressively goes after inflation” tech could “wilt.”

The market is treated with kid gloves when it comes to the Fed or anything else that could have an outsize impact on it and that includes FAAMG. It’s possible that Congress might try to send a signal by making an example of one company (the Metaverse comes to mind), but that would require Republicans and Democrats to come together, something unimaginable these days.