Good news! The increase in US recession odds associated with SVB’s collapse was a false alarm. The probability of a downturn for the world’s largest economy over the next 12 months is no greater than it was prior to March’s regional banking turmoil.

Or at least according to Goldman’s Jan Hatzius, who on Tuesday cut the bank’s subjective (“judgmental”) odds of a US recession back to 25% from 35%, “undoing” the upward revision catalyzed by SVB’s implosion.

Hatzius cited two factors. First, and most obviously, the threat of a debt ceiling worst-case was removed. The spending cuts implied in the Biden-McCarthy deal are essentially immaterial for the purposes of estimating the fiscal impulse looking out two years, Hatzius suggested.

Second, Goldman is now “more confident” in the notion that the drag on real growth from the bank stress will prove modest, even as the economy is “getting a sizable boost from the recovery in real disposable income and the stabilization in the housing market.”

On net, that leaves Goldman’s growth forecast at 1.8%, a country mile above consensus and far more rosy than the Fed’s forecasts (recall that staff sees a shallow recession).

The figure above gives you some context for just how relatively optimistic Goldman is. Consensus puts the odds of a recession over the next 12 months at around two-thirds. Goldman has consistently maintained a relatively upbeat view.

As for whether the Fed will ultimately need to engineer a recession to corral inflation, Hatzius reiterated the familiar economist talking point: It all hinges on whether (and, more to the point, how) the labor market rebalances. There too, he’s optimistic. “For over a year, the US economy has found ways of creating large numbers of jobs while keeping the unemployment rate very close to its pre-pandemic level of 3.5%,” Hatzius wrote. “Once again, we note that this cycle is different.”

And yet, Goldman does see another hike, likely in July, consistent with the notion that even if “immaculate disinflation” is possible, better growth outcomes open the door to higher for longer rates.

“The [Fed] leadership seems quite willing to signal additional hikes down the road, potentially via a higher peak rate in the June dot plot,” Hatzius went on. “Together with our above-consensus growth forecast, this has led us to add a 25bps hike, most likely in July.”

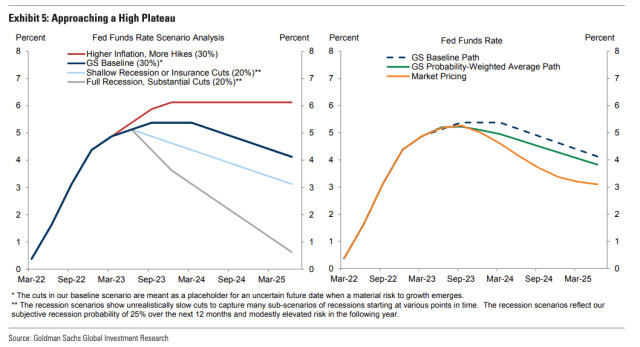

The figures give you a sense of how Goldman sees the Fed path evolving under various macro scenarios (left-hand chart) and also how the bank’s baseline outlook compares to consensus (on the right).

“We see a long pause of about a year, followed by very gradual cuts,” Hatzius reiterated. “On a probability-weighted basis, we continue to think that the rates market is underpricing the outlook for the funds rate over the next 1-2 years.”

Related: Saved By The Beveridge Curve (This Time Is Different)+

Curious what y’all think as most of the audience has more experience in the industry.

For me, I can’t help but be reminded by Kolanovic’s posit about every carry trade can’t be saved. Higher for longer still means something’s going to break, right? The Fed, and certainly not the US Gov can act quickly to stem every crises before it happens, or can they?

Despite my bias toward the US economy being difficult to bet against, especially given the global situation, Goldman’s take feels too tidy — someone is going to get punched in the nose even though I don’t wish it on anyone.