There may be a light at the end of the tunnel when it comes to the liquidity-volatility-flows “doom loop” in equities.

Over the past couple of weeks, market participants off all stripes were suddenly forced to come to terms with the fact that the pernicious, self-feeding loop between systematic flows, volatility and market depth is not just some ghost story that only “seems” real episodically during fleeting bouts of technical tumult (e.g., the VIX ETN “extinction event” during the week of February 5, 2018).

Rather, this post-crisis dynamic wherein everyone is, in one way or another, short vol. and thereby operating under the same risk management regime (i.e., more leverage is mechanically deployed as markets trend higher/vol. grinds lower, setting up forced de-leveraging into a ‘VaR-shock’), is not only real, but capable of collapsing markets, from equities to rates to FX and back again.

In short: The Babadook (as it were) isn’t just in our heads. This is no psychological thriller. This dynamic is real, and during the COVID-19 crisis, it has manifested in some of the most chaotic, untradeable markets ever witnessed.

Read more: The Biggest VaR Shock Since Lehman & The Risk Parity Panic

But the good news is, at least one key aspect of the doom loop may be on the verge of short-circuiting.

“US Equities have passed a first critical hurdle with regard to [the] technical factors which have kept moves so extreme over the past month and a half within the Equities/Vol space [with] the ‘clearing’ of yesterday’s VIX March serial expiration”, Nomura’s Charlie McElligott writes on Thursday, before noting that “we still need to clear the index and ETF ‘short Gamma’ dynamic, which remains considerable due to the enormous S&P ‘Put Wing’ flows”.

That means getting past the Quad Witch on Friday, where, on Nomura’s latest assessment of SPX/SPY options Greeks, the bank sees scope for some 47% of $Gamma to drop off.

(Nomura)

Assuming that pans out, the post-expiration reality could be calmer, as dealer hedging would be less prone to exacerbating directional moves.

It would mean “incrementally less sensitivity to changes in underlying Delta and thus [less] forced hedging ‘momentum’ (selling into selloffs, buying into rallies)”, McElligott goes on to write, adding that we “could even ultimately move closer to a place where ‘rich vol.’ may be sold again to dealers, which could then mean a partial return to standard ‘long Gamma’ insulating flows”.

Fingers crossed, as this isn’t a sure thing. Or, to the extent some of it is assured, there are a lot of “ifs”.

“CLEARLY, all of this is subject to the progression of the virus and the impact it will have on global growth and risk sentiment”, McElligott cautions, emphasizing the word “clearly”.

As we look ahead to a (hopefully) less turbulent landscape for equities, I want to reiterate that what market participants have witnessed of late is stone, cold proof that modern market structure and the “stability breeding instability” dynamic it facilitates is dangerous.

Every aspect of the “doom loop” ghost story (from dealer hedging flows exacerbating swings to CTAs piling on, propagating their own negative momentum to vol.-targeting funds de-leveraging as trailing realized is pulled higher to risk parity unwinds in the final, nauseating act as cross-asset correlations “go to 1”, so to speak) was realized at one time or another over the past 30 days.

On Wednesday, as both stocks and bonds sold off in unison, I went back over the risk parity unwind, and later noted that “home-brew”/”faux” risk parity is likely experiencing a catastrophic collapse.

On Thursday, McElligott writes that over the past 18 days, the bank’s model ‘World 60/40’ fund is down -15.5%.

(Nomura, BBG)

That, Charlie writes, is “a greater than a -8 SD move and truly unprecedented dating back to our model’s 1999 start-date”.

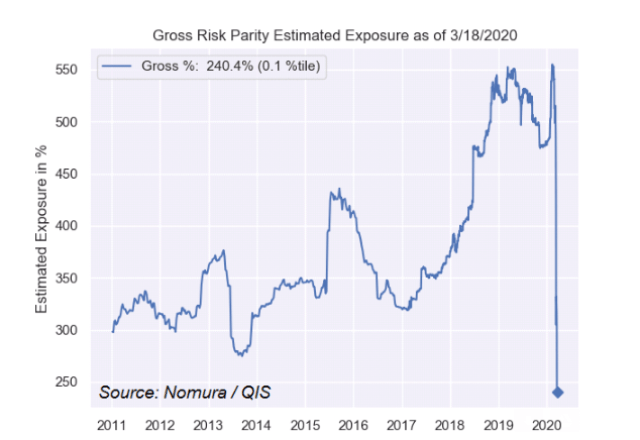

But as dramatic as that most assuredly is, McElligott suggests that the truly astonishing (and related) move is manifested in the bank’s risk parity model where “the feedback loop of forced deleveraging/stop-outs in light of the extreme realized volatility mechanically ‘triggering’ de-risking” has resulted in a “remarkable slashing of gross-exposure”.

(Nomura)

What that shows is risk parity exposure being gashed from the 100th percentile to the 0th percentile – in less than six weeks.

“The proliferation of VaR sensitive investors, such as hedge funds, mutual fund managers, risk parity funds, variable annuity funds, banks, dealers and market makers raise the sensitivity of markets to self- reinforcing volatility-induced selling”, JPMorgan’s Nikolaos Panigirtzoglou wrote Friday.

Again, The Babadook is real.

Read more: We’re All Momentum Traders Now

Professor H: I am learning so much from you. Stay sheltered in place, for yourself and all of your followers.

How much of this boom-bust can be laid at the feet of taxable dividends and tax-free buybacks? We have designed our markets to act this way because each CEO will keep running the same game.

You know, reading your comment it struck me that the reason “we” let this BB crap go on — airlines spent 90% of their cash on buybacks for years and now they want a $60bil bailout — is because we have all been riding along. It seems like we’re just a bunch of gnarly street kids on skate boards grabbing the back of the garbage truck for the speed thrill. Just sayin’

In an article today entitled “Harried Traders Gird for a Frantic Friday,” the WSJ speculates that “If many options expire Friday and new positions aren’t established, some traders said that could help push volatility lower.” I hate to say it, but, considering what we pay for the WSJ, Heisenberg would be justified in charging more for the extra insight that he provides.

This article was one of the best I’ve read — fantastic job.