Donald Trump is a man who knows an “exciting” plan when he hears one, and because he’s usually “speaking with himself“, when he’s excited about a plan, it’s typically something that emanates from that “very good brain” of his.

Such is the case for the revamped corporate strategy the President unveiled on Tim Cook’s behalf over the weekend, following news that Apple sees the next prospective rounds of tariffs on China affecting a long list of products, including Apple Watch and Air Pods. That news hit late Friday and sent Apple shares tumbling just before the closing bell on Wall Street.

“Apple prices may increase because of the massive Tariffs we may be imposing on China but there is an easy solution where there would be ZERO tax, and indeed a tax incentive”, Trump tweeted on Saturday, before detailing his idea as follows:

Make your products in the United States instead of China. Start building new plants now. Exciting! #MAGA

Now, for one thing, it’s not as if Apple hadn’t thought of that. There’s a reason they source from China and it’s not because Tim Cook hates America. Obviously, making every single component part and assembling every single product in California would likely drive prices on some of the company’s already expensive products through the roof.

But Trump either doesn’t grasp that simple concept or more likely, doesn’t care. So here we are on Monday with Apple suppliers plunging in Greater China trading, both because of his Saturday tweet and because the company now faces a tough decision: Eat increased production costs associated with the tariffs or raise prices at the potential cost of demand destruction and market share loss in the U.S.

Hon Hai Precision fell more than 3% on the session, its worst day since May. Shares trading in Taipei are now sitting at their lowest levels since summer of 2016.

Also hit hard was Pegatron, which dove nearly 4% to its lowest since 2014:

And don’t forget about Largan, which fell a truly horrible 7.82% – this would be the third day this year the shares have fallen 7% or more in a single session:

Meanwhile, in Hong Kong, AAC Technologies was one of the worst performers on the Hang Seng, falling 3.6% to its lowest since February 2017.

Luxshare Precision dove a truly laughable 10% in Shenzhen, its worst day in more than two years.

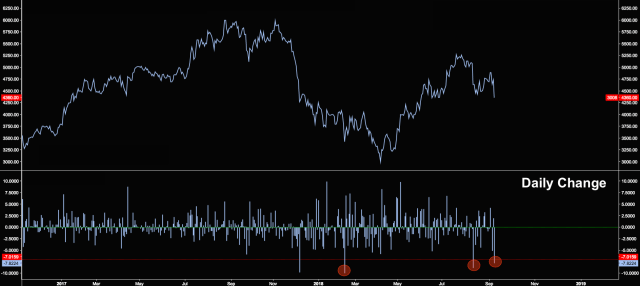

More broadly, the Hang Seng had a rough day, falling 1.3% – it’s teetering on the edge of a bear market:

Notably, the Shanghai Composite is back near the 2016 lows. As a reminder, that’s where state-backed funds (i.e., the vaunted “national team”) started buying last month.

Read more

China Is Now Intervening To The Tune Of ‘Billions’ In The Stock Market And That’s Not All

You can probably expect more state support in the days and weeks ahead in the event further trade tensions push mainland shares beyond the 2016 closing lows.

Here’s the bottom line from Kevin Chung, an analyst at JihSun Securities Investment Consulting, quoted by CNBC on Monday:

People are in a bit of a panic today. Looking forward, the focus would be on how the market reacts after Apple releases its latest models.