The euro dove to a one-year low on Friday after the Financial Times tipped ECB consternation about some European banks’ exposure to Turkey amid the ongoing collapse in the lira.

Although the central bank doesn’t believe the situation is “critical” (to quote FT), officials reportedly see BBVA, UniCredit and BNP Paribas “as particularly exposed” given their extensive businesses in Turkey. Shares of all three banks were hit hard on Friday although really, it’s not as bad as it could be – yet, anyway.

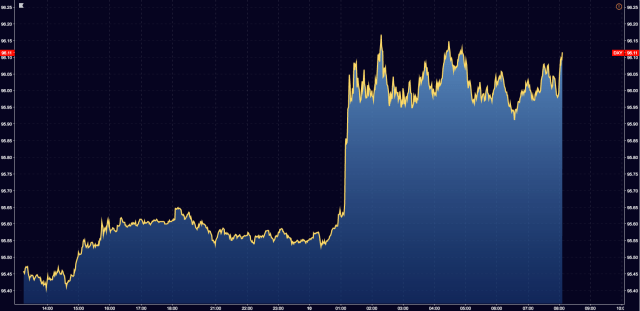

EUR/USD ran stops, falling below 1.15, while the dollar index surged to a YTD high just after the story hit and as traders digested the implications.

“The euro is getting smoked on the FT story and breaking through key support in the process,’’ Rodrigo Catril, an FX strategist at National Australia Bank in Sydney said as the situation unfolded.

(The euro falls quickly as traders digest FT story on European bank exposure to Turkey)

FT’s reporting and belligerent comments from Erdogan would ultimately cause capitulation in the lira, which collapsed more than 13% at one point. In addition to the ECB’s concerns about certain European banks and the read-through from those concerns for monetary policy, the situation in Turkey is a stark reminder for the market about what can happen when fiscal mismanagement collides with populist tendencies.

(EURUSD at one-year low as concerns about Turkey ripple across markets)

Markets were already on edge about the path of fiscal policy in Italy, so this was effectively gas on the fire. “The euro has come under pressure as the issue of Turkey reminded players of the Italian political situation”, Shinkin Asset Management’s Jun Kato said today.

The Stoxx 600 banks index fell more than 1.5% on Friday.

Notably, iTraxx SubFin spreads blew out some 14bps to 177 – this would be the index’s worst day in months. SenFin was wider by 4bps to 84 – the three worst-performing credits: UniCredit, BBVA and BNP Paribas.

Finally, do note that the dollar’s spike on the FT story (concurrent with the euro’s dive of course) won’t please Donald Trump. Because this is in part catalyzed by sanctions on Turkey, it’s just another example of the President discovering how difficult it truly is to keep all the policy balls in the air.

(Dollar index surges to YTD high following FT story)